The Path to

AI Maturity 2023

Introduction

In this year’s LXT research study on AI maturity, we focused from an AI perspective on key themes of investment, maturity, drivers of strategy and industry trends, and also explored attitudes towards responsible AI and AI data. Our research this year revealed increased levels of AI investment, and a greater proportion of the organizations surveyed assessing themselves as operating at higher levels of AI maturity. We also found that with a climate of economic downturns as context, business agility has come to the forefront as a driver of AI strategy. From a solutions perspective, NLP, Speech and Conversational AI solutions were the most commonly deployed across industries, with Conversational AI leading in terms of ROI.

An encouraging finding from this study is that 80% of companies state they have developed a data strategy to support their AI initiatives. As AI is a data-driven technology, it is critical for organizations to build a solid plan for data collection and enhancement that will allow them to build better AI. Participants understand the importance of using high-quality training data for their AI solutions to generate more successful outcomes.

Finally, we are pleased to report that companies are actively implementing techniques to manage bias in their AI applications, and are addressing ethics and fairness in AI head on. As adoption of AI technology continues to grow, it is increasingly important for organizations to ensure good oversight is in place.

As AI continues to demonstrate its transformational capabilities for organizations across all industries, it is imperative for companies to prioritize building and implementing their AI strategies. Our goal with this research study is to provide insight into the overall AI landscape and the attributes of companies that have reached the higher levels of AI maturity where the technology is delivering a tangible return on investment to their businesses. If you have questions about the research or would like to suggest a topic for consideration in the future, please contact us at info@lxt.ai.

Research Overview

The Path to AI Maturity is an annual research study by LXT aimed at understanding the overall AI maturity of mid-to-large organizations located in the United States, along with AI investment levels, key business drivers for AI, the role of training data in AI projects and more.

This report is the second annual survey commissioned by LXT and represents the views of leaders in 315 companies, a 57% increase in sample size from last year’s survey. Respondents are senior executives that are closely involved in their organization’s AI initiatives.

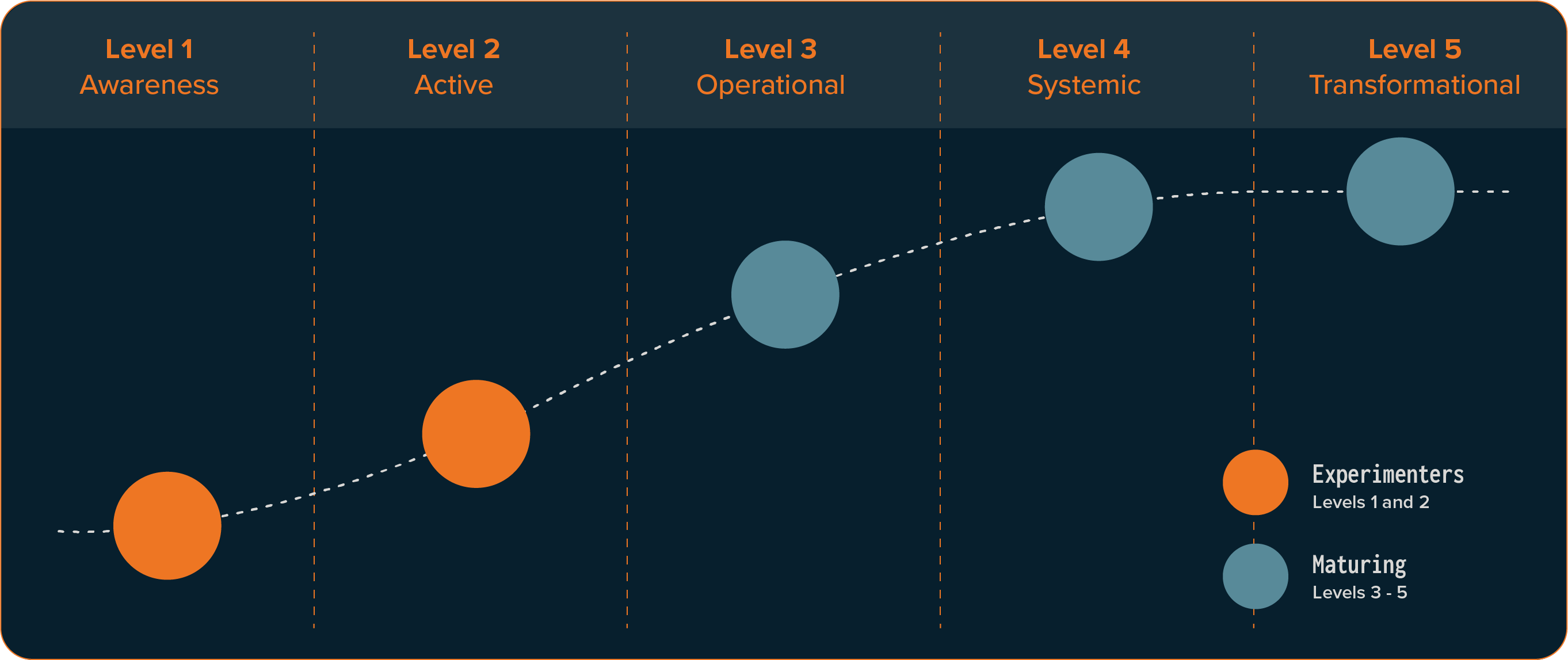

The study uses Gartner’s AI Maturity Model which characterizes an organization’s journey with AI into 5 levels:

Gartner’s AI Maturity Model levels

- Level 1: Awareness – An early interest in and conversations around AI strategy

- Level 2: Active – Initial experimentation and pilot projects with AI

- Level 3: Operational – AI in production, creating value through process optimization or product/service innovations

- Level 4: Systemic – AI is pervasively used for digital process and chain transformation, and disruptive new digital business models

- Level 5: Transformational – AI is inherent in the DNA of the business

Main findings

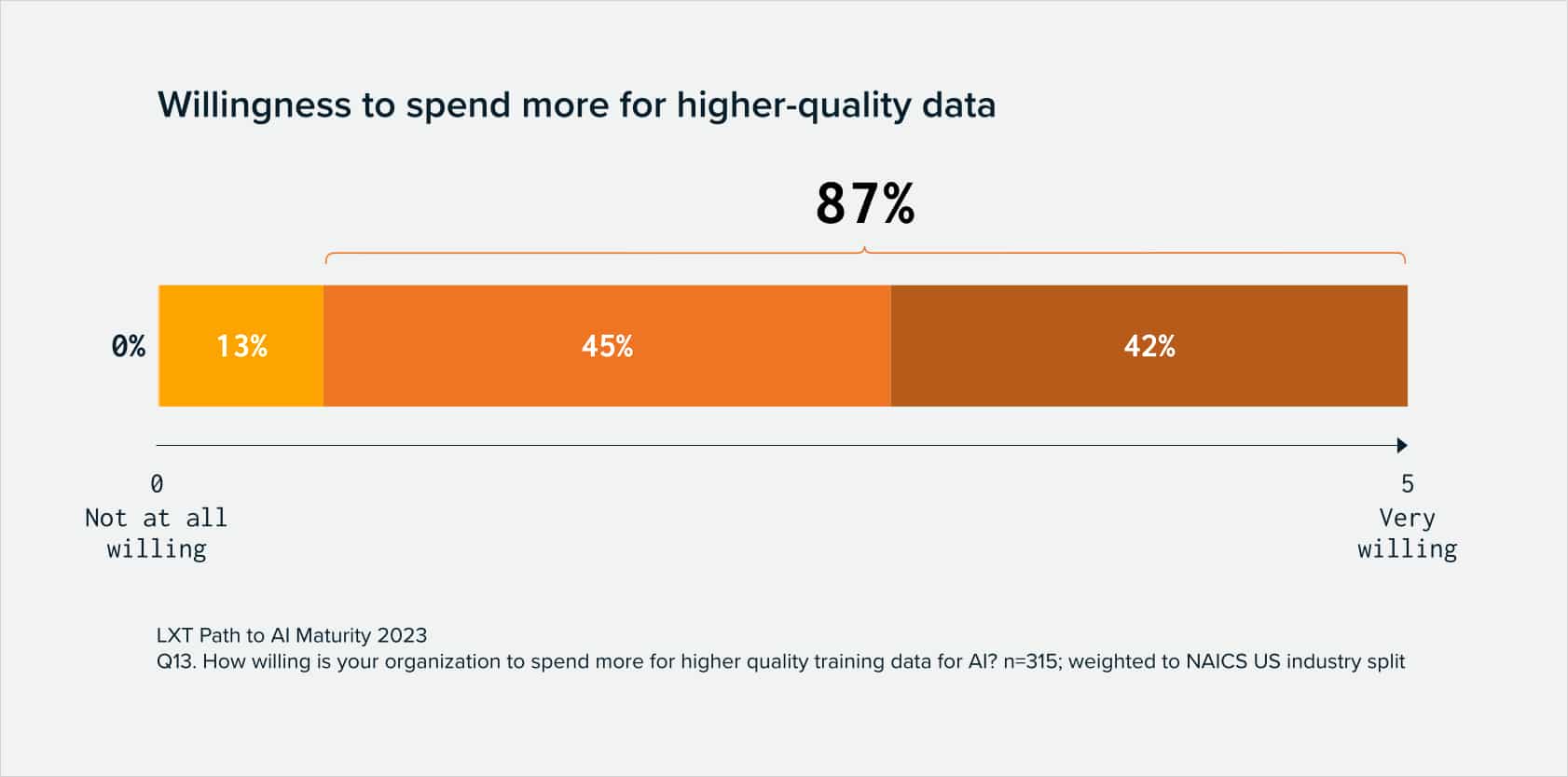

87% of companies are willing to pay more for high-quality training data, and as a result the demand for AI training data continues to be strong.

Want to read this report later?

Summary of findings

AI investment and drivers

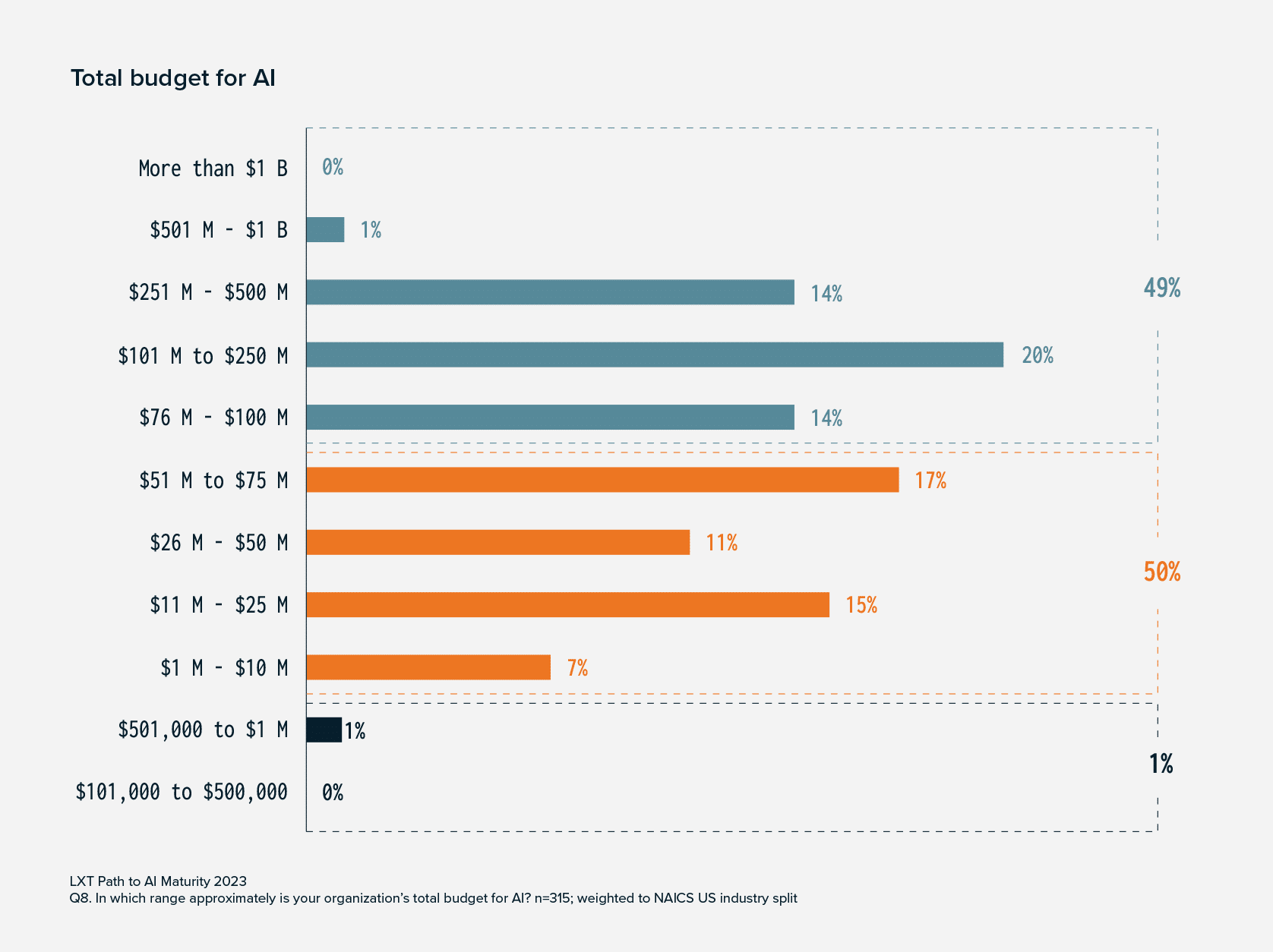

- Close to half (49%) of organizations surveyed have AI budgets of $76M or more.

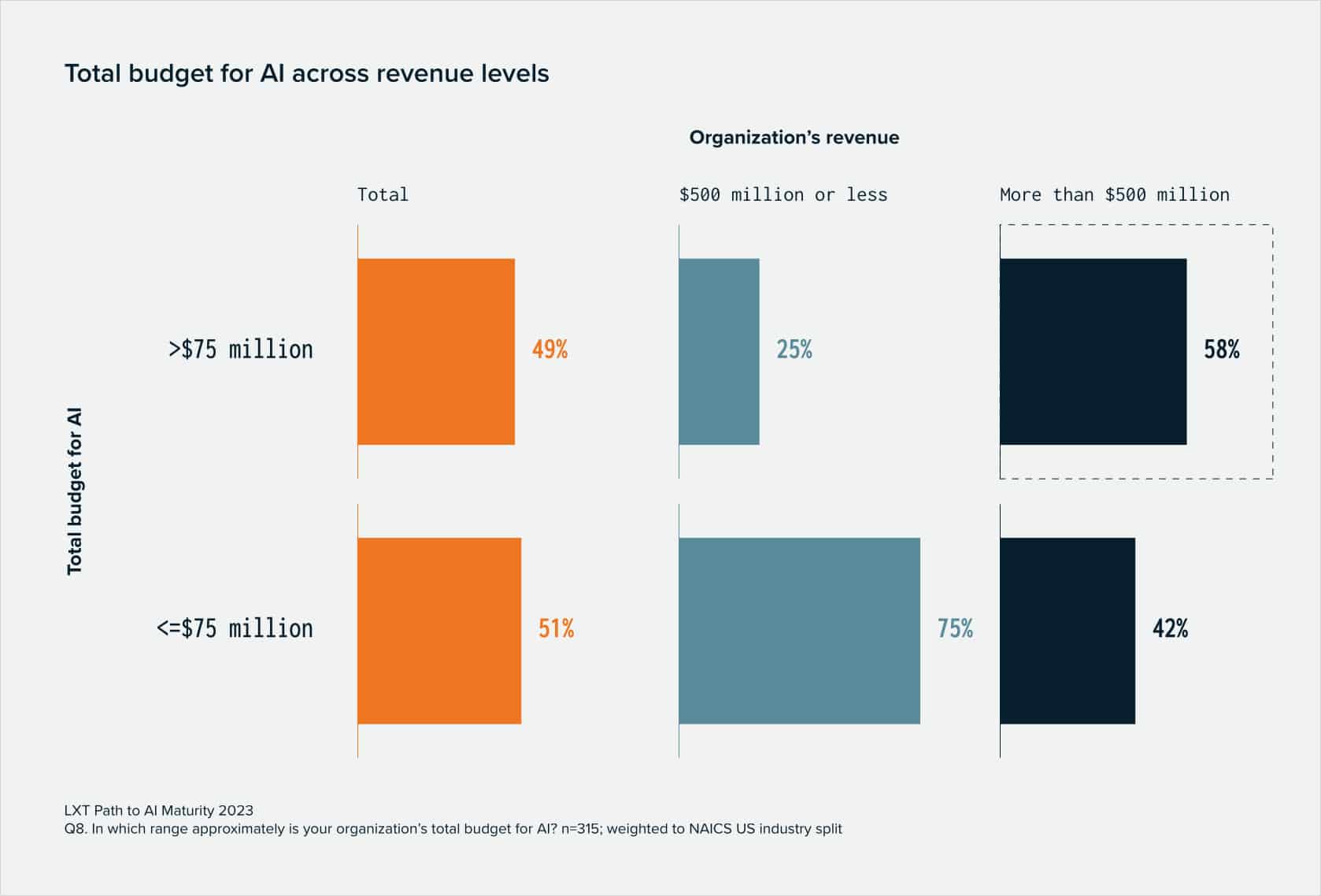

- The majority (58%) of high-revenue companies (more than $500M in annual revenue) have AI budgets above $75M.

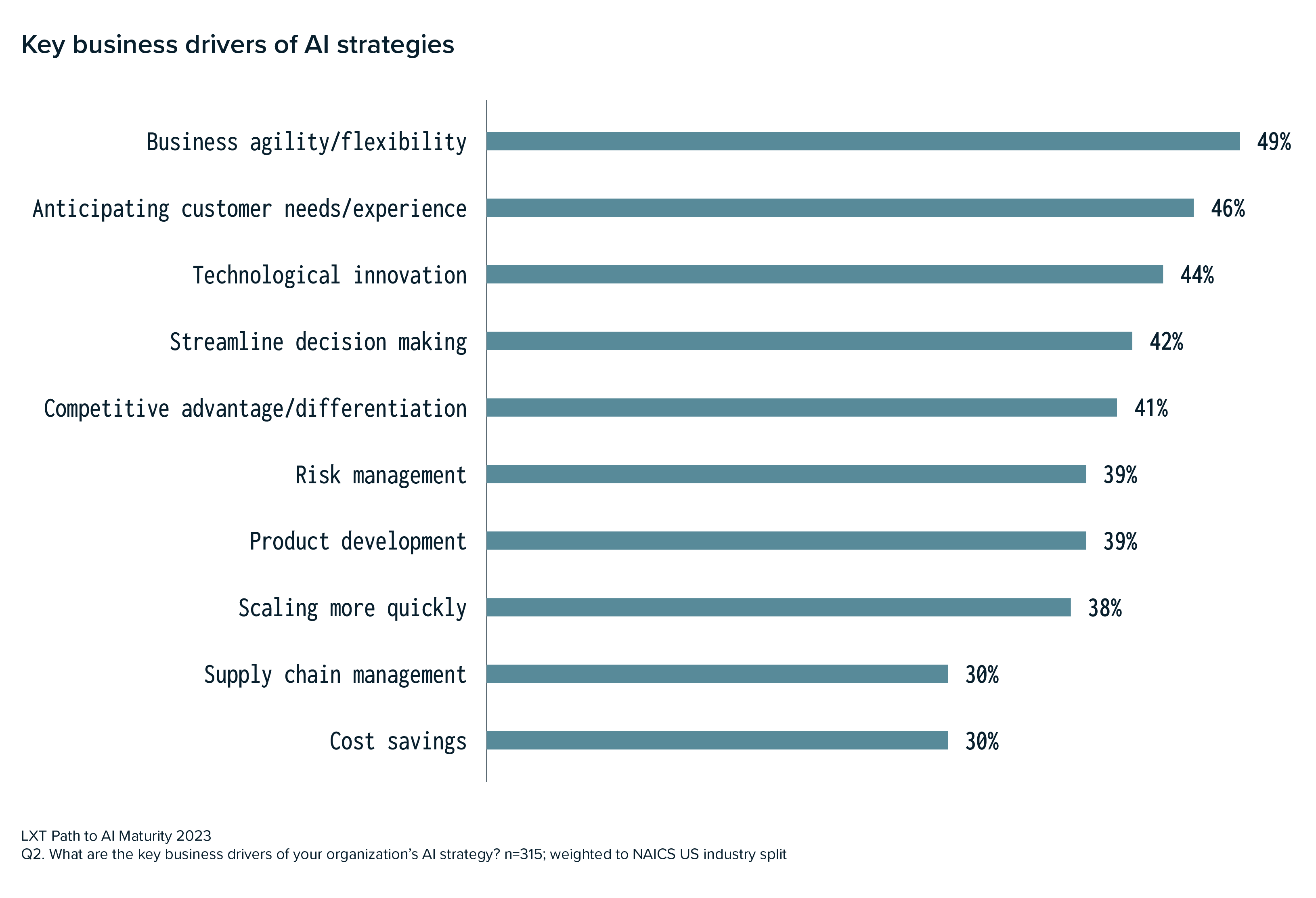

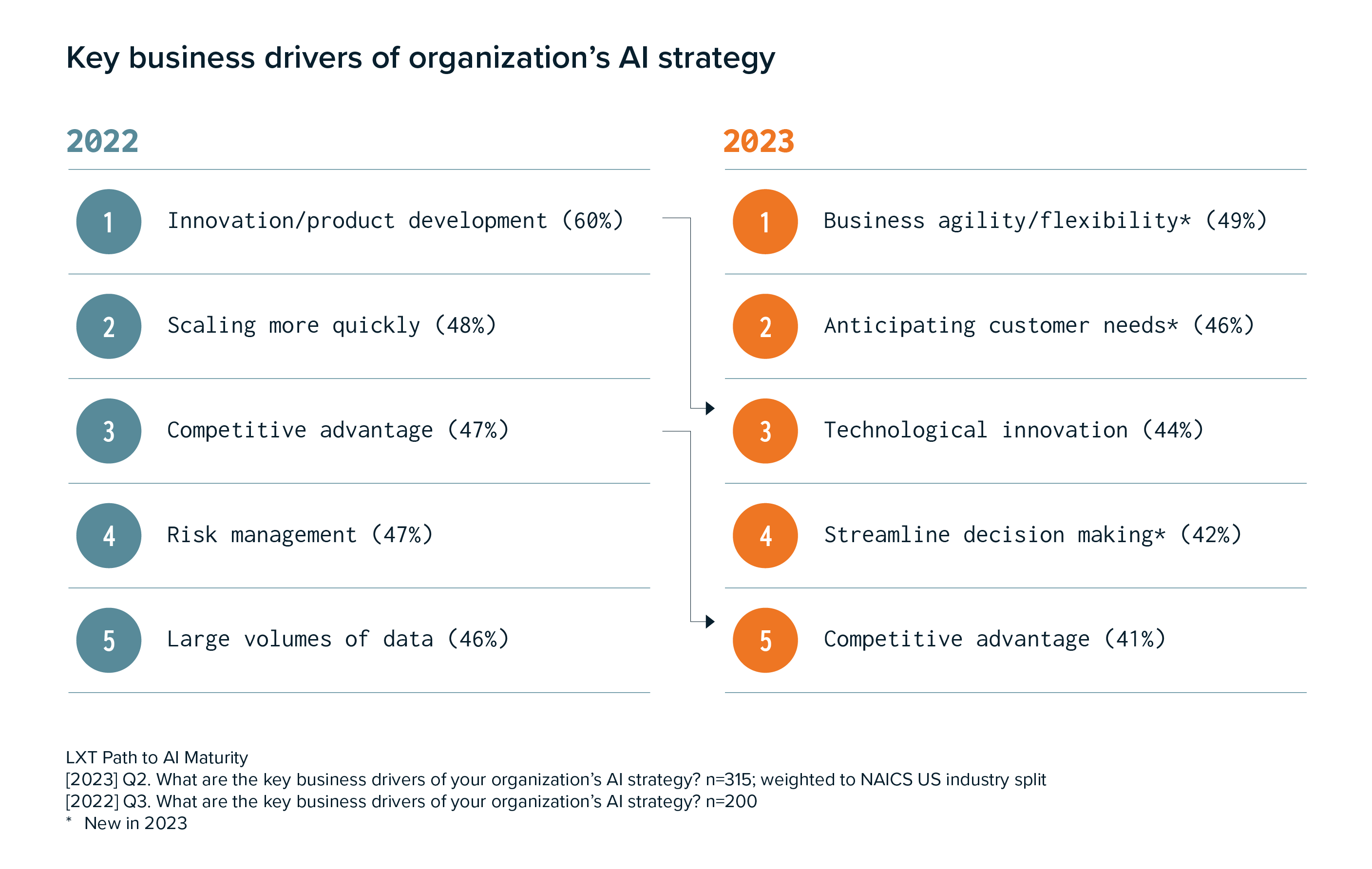

- AI strategies are driven by business agility, anticipating customer needs and technological innovation.

- Cost saving is not a dominant driver for organizations that are deploying AI strategies.

- AI can help companies improve business agility during times of economic uncertainty.

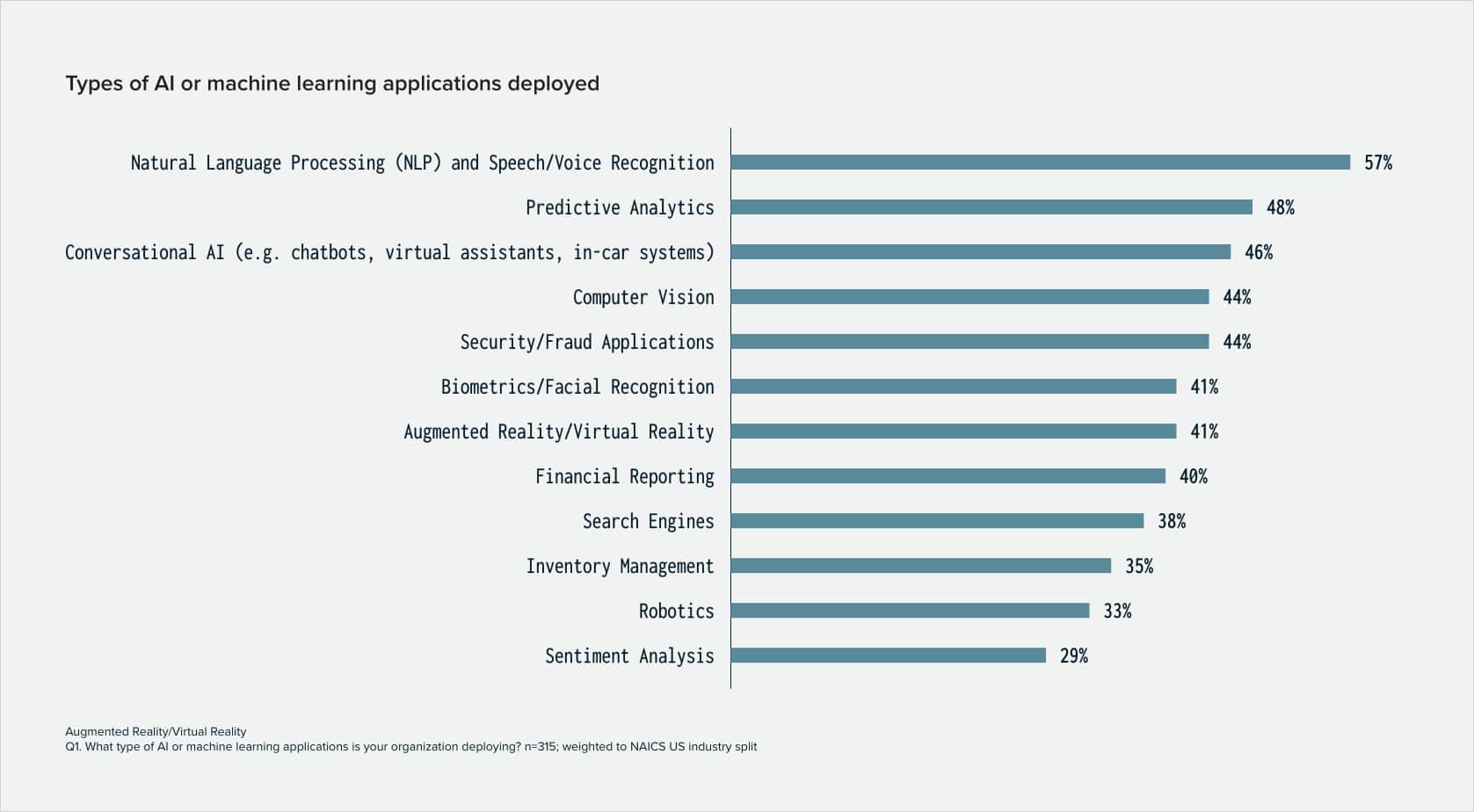

- Natural Language Processing (NLP) and Speech Recognition solutions are the most commonly deployed AI applications.

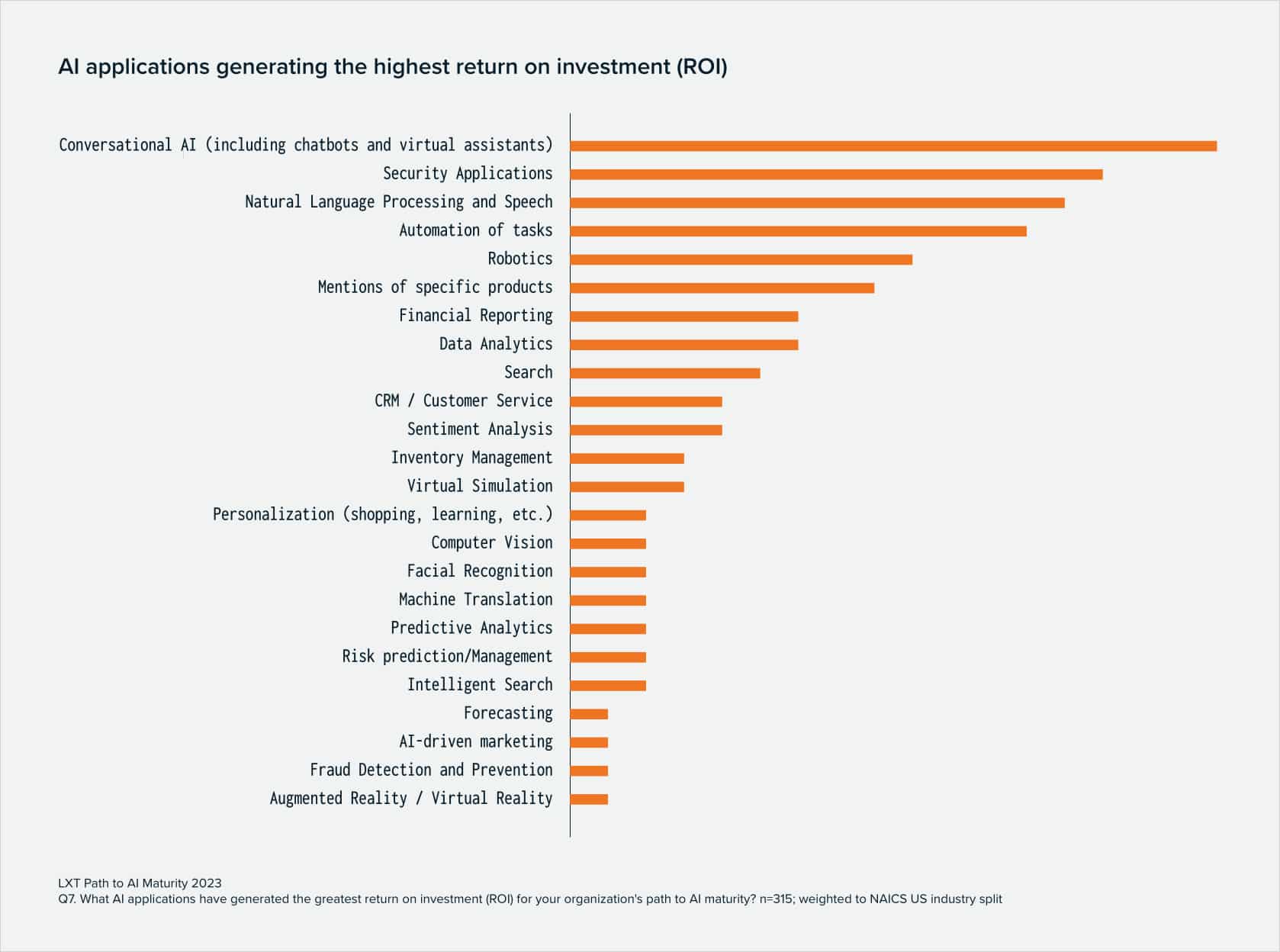

- Conversational AI solutions have delivered the highest return on investment.

AI maturity trends

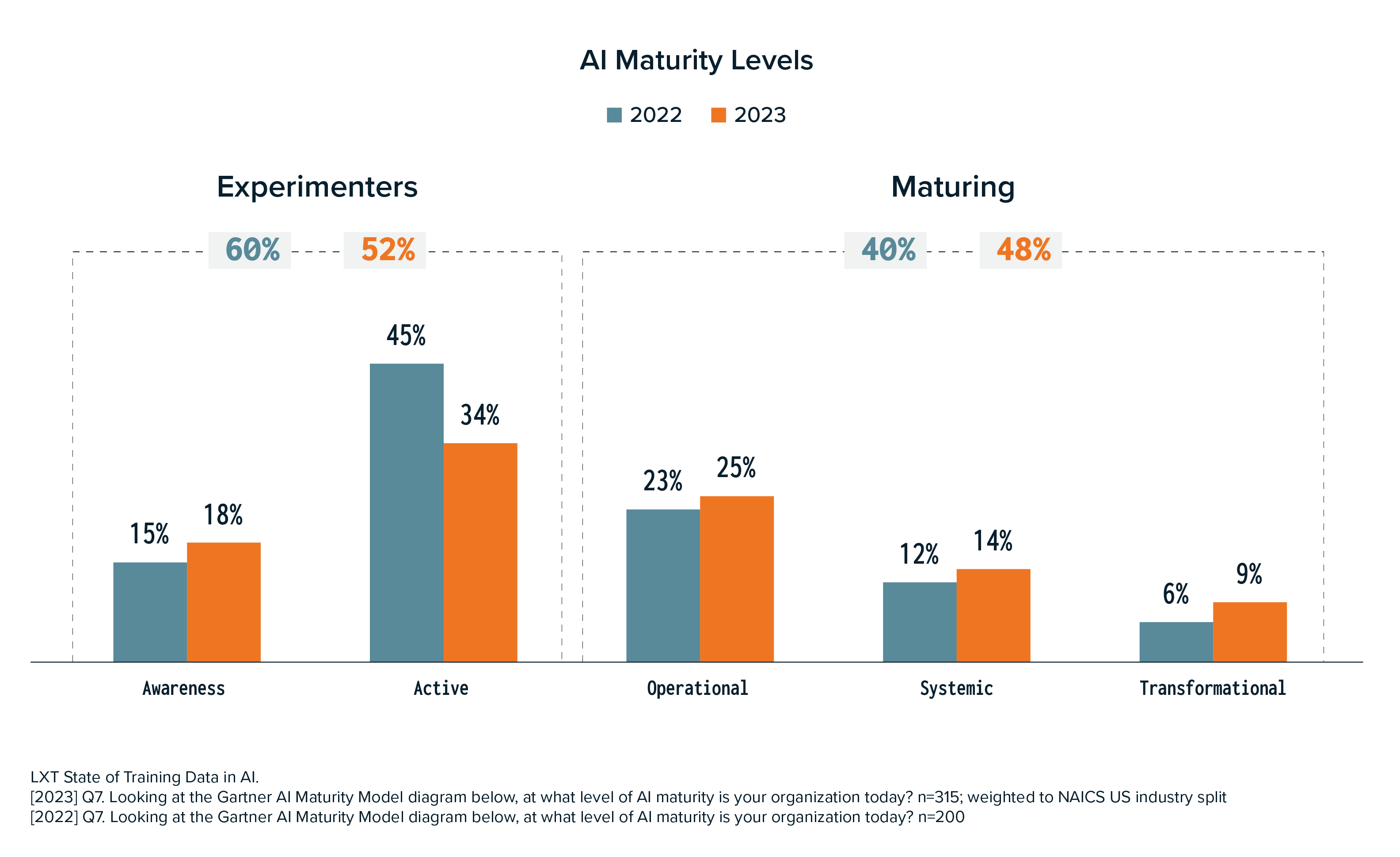

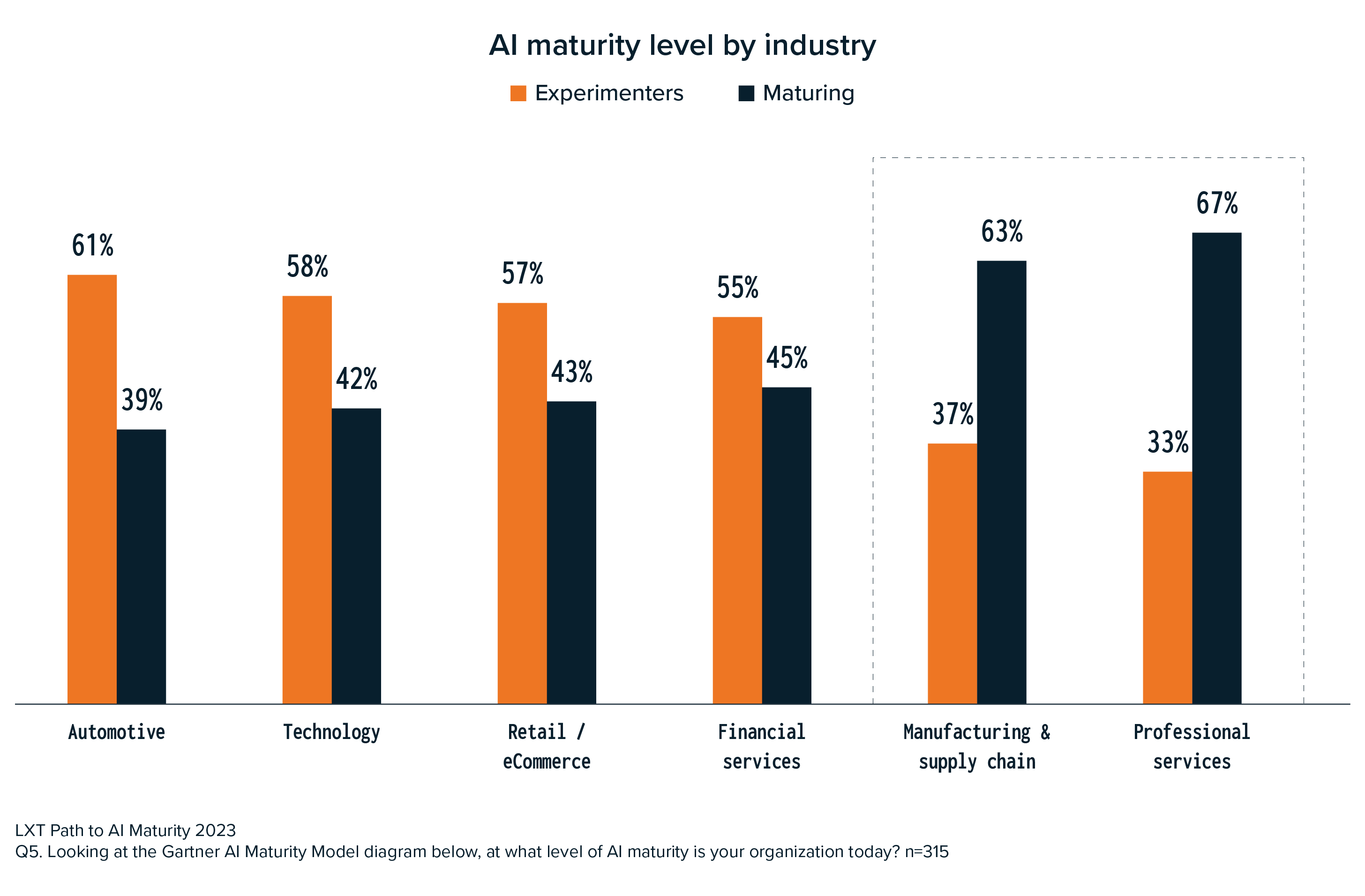

- Close to half (48%) of mid-to-large US organizations report having reached the higher levels of AI maturity (Maturing). This represents an 8% increase from last year’s survey results.

- 52% of mid-to-large US organizations are still experimenting with AI (Experimenters).

- Maturing organizations are more likely to use AI to drive future advantage; Experimenters are more focused on risk management.

- In uncertain economic conditions, bringing new products to market quickly is seen as a significant benefit to Maturing companies.

- Companies that have reached the highest levels of AI maturity rely most on supervised machine learning methods.

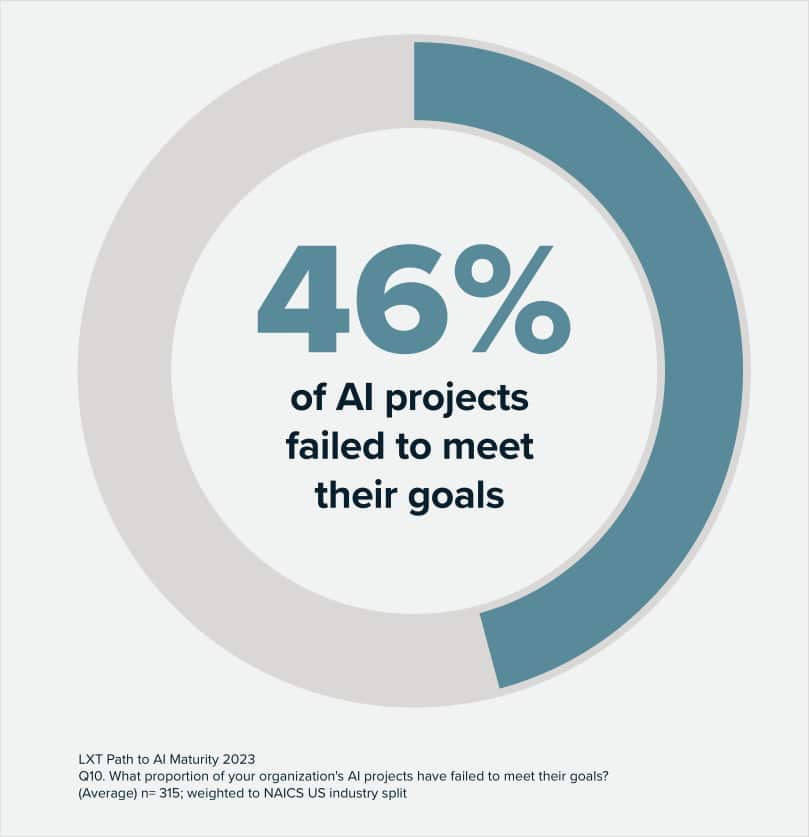

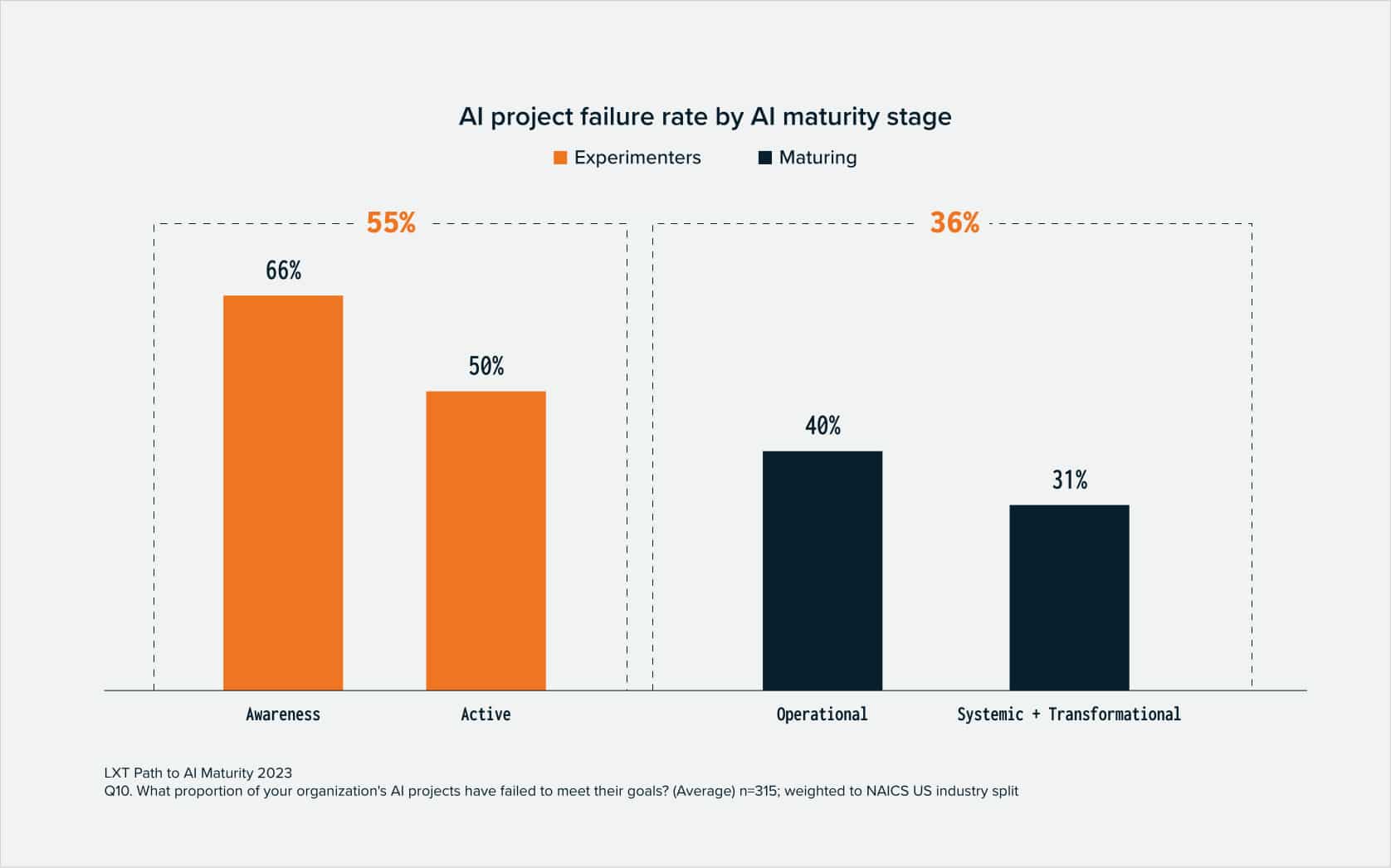

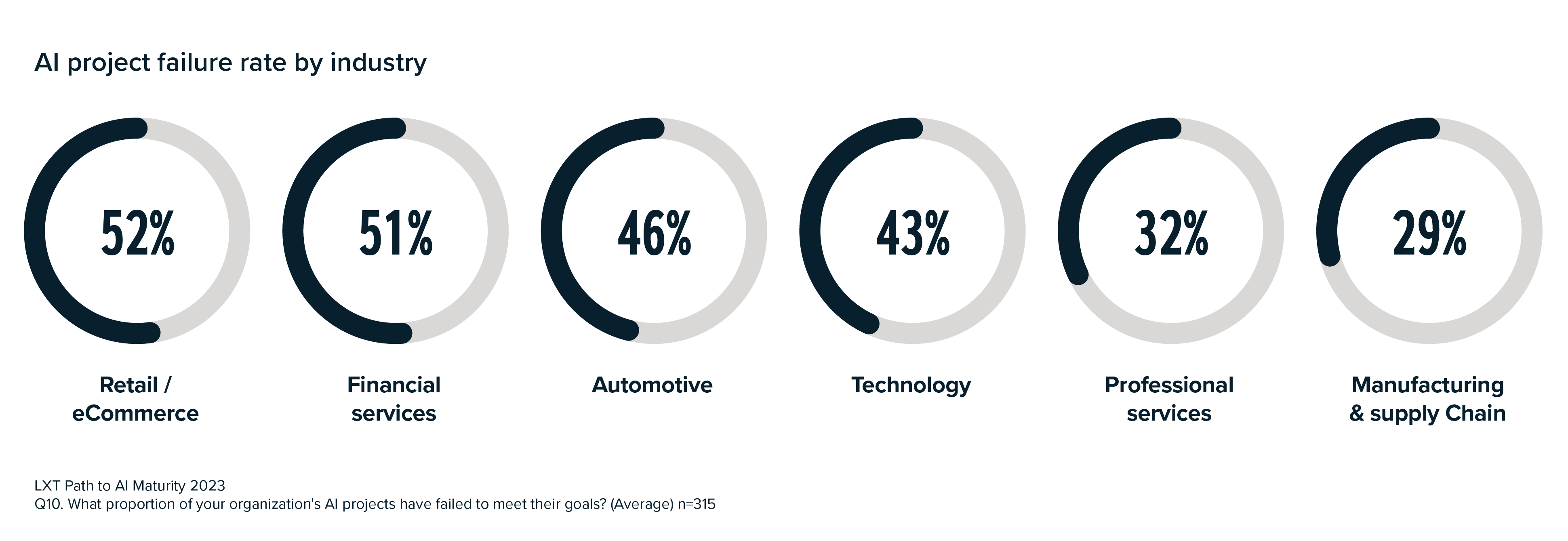

- On average, 46% of AI projects fail to meet their goals, but the success rate increases as a company progresses in its AI maturity journey.

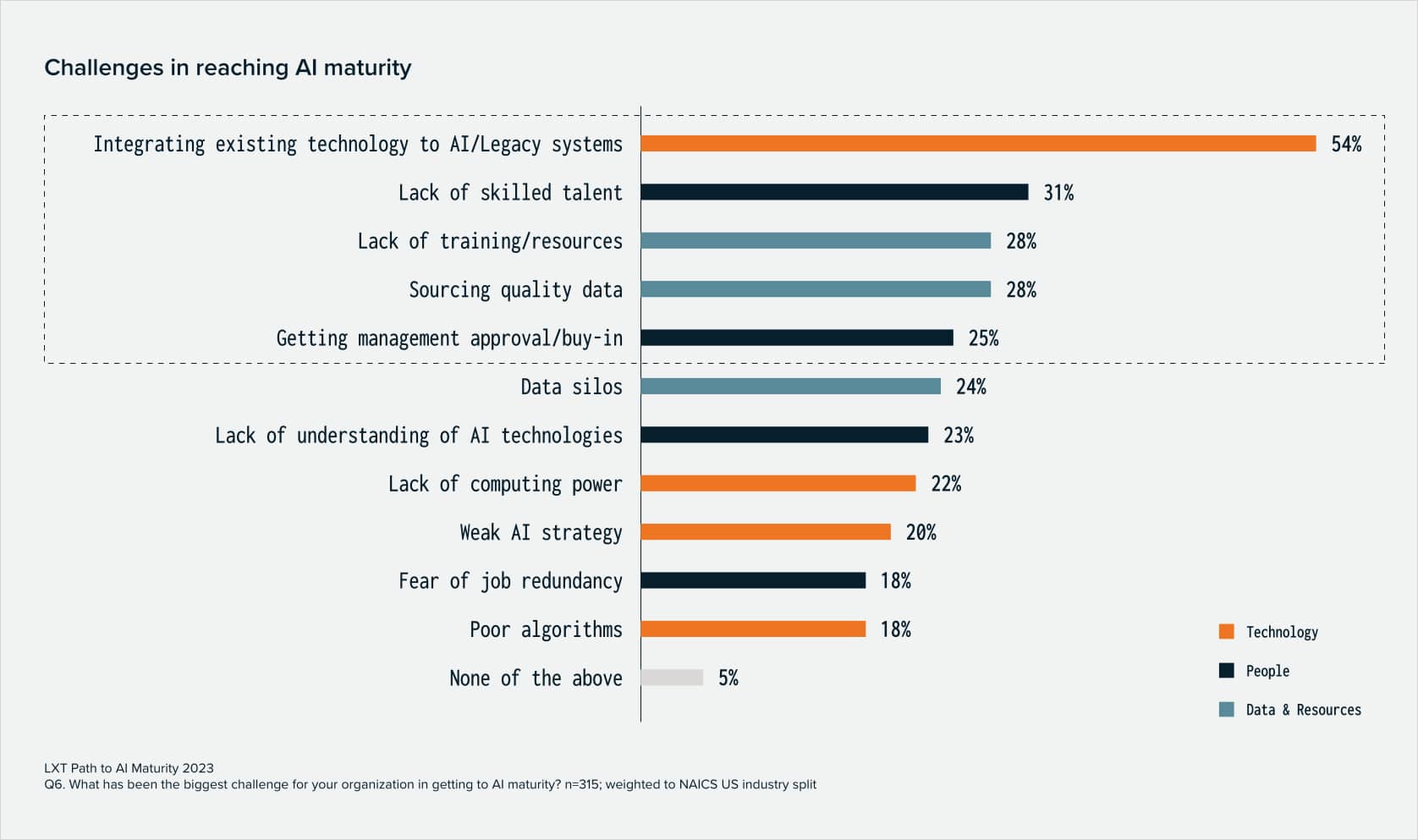

- Integrating AI with existing technologies is the biggest barrier to reaching AI maturity.

AI data trends

- Over 80% of organizations have implemented a data strategy to support theirAI initiatives.

- The majority of organizations use annotated(72%) and/or or synthetic (63%) data to train their machine learning models.

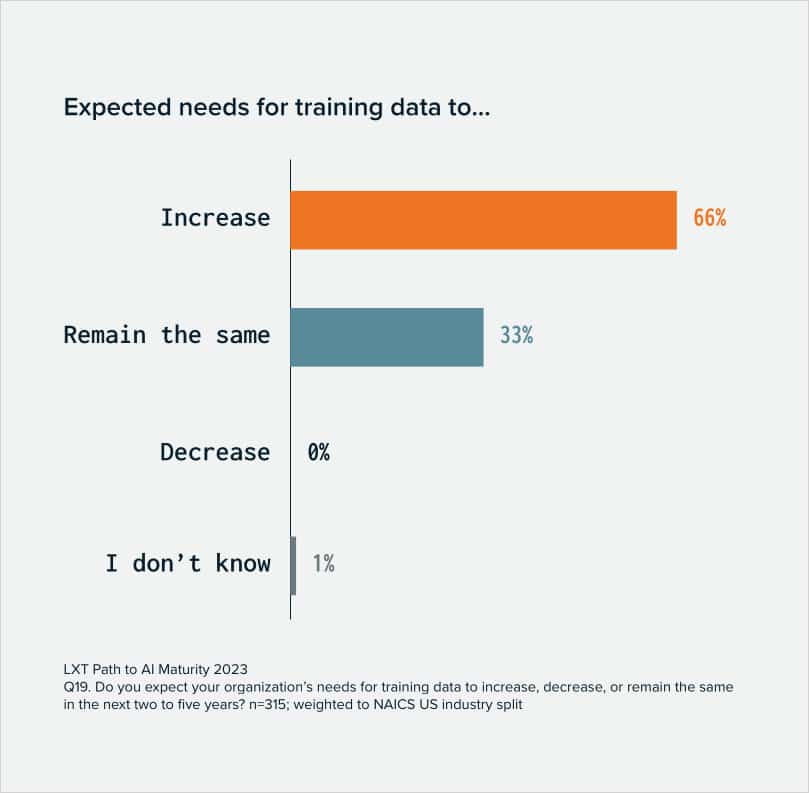

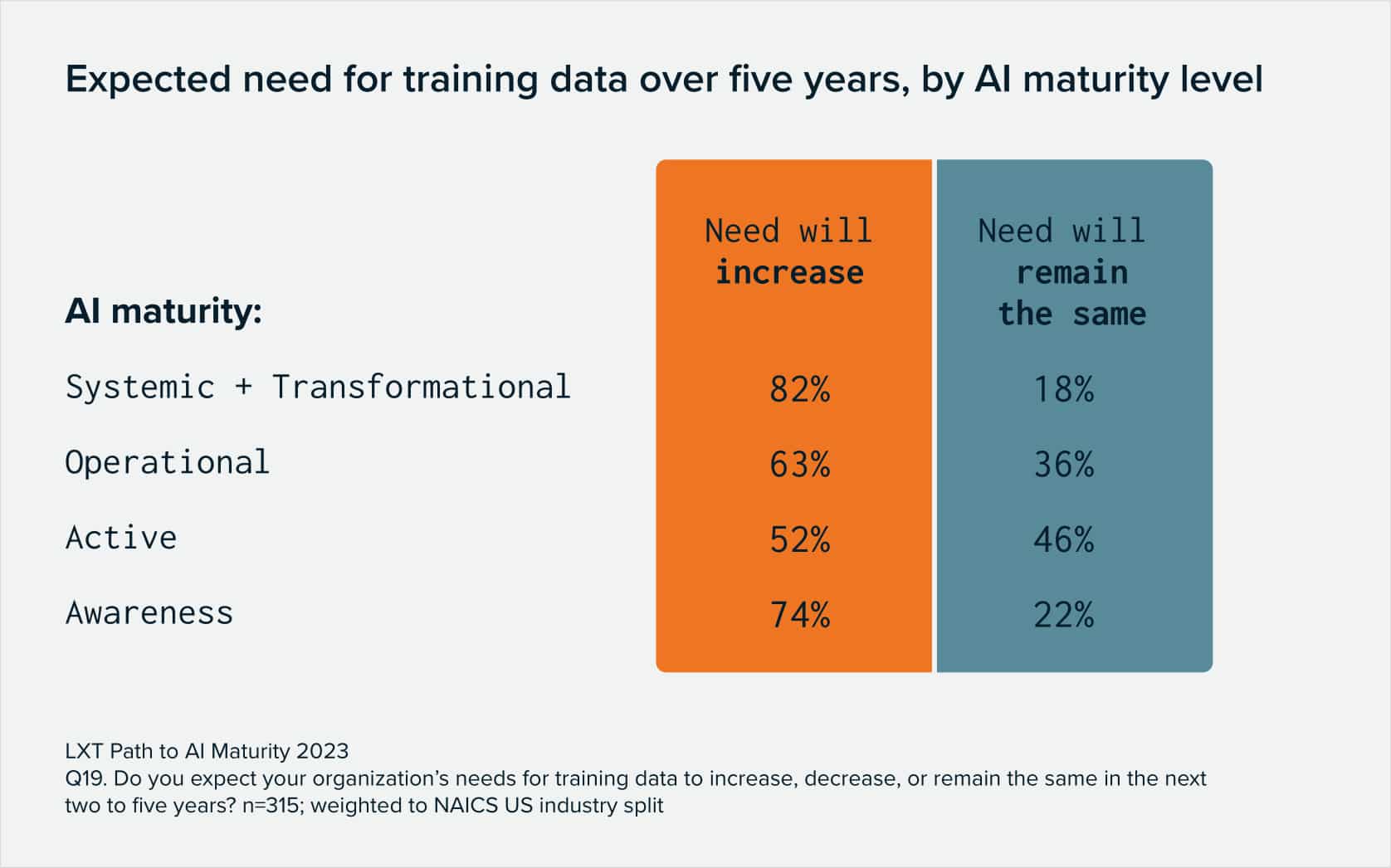

- The need for training data is high and will continue into the future; two thirds of respondents stated that their needs will increase in the next two to five years; none of the respondents expect data expenditure to decrease.

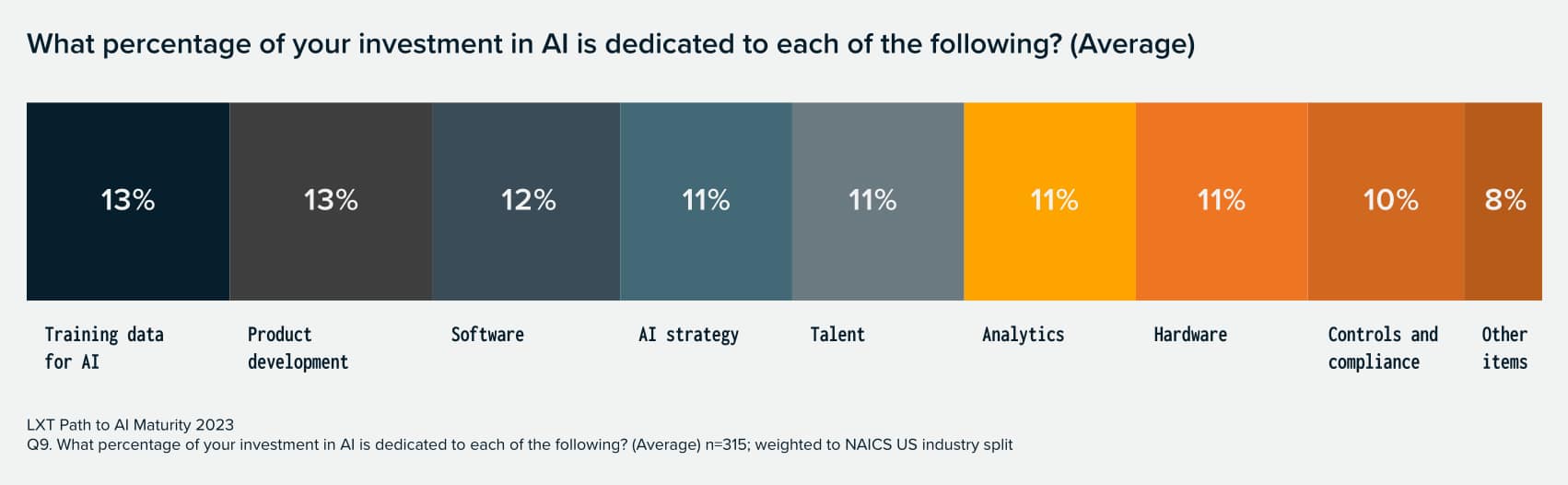

- Training data for AI (13%) and product development (13%) account for the largest share of AI budgets.

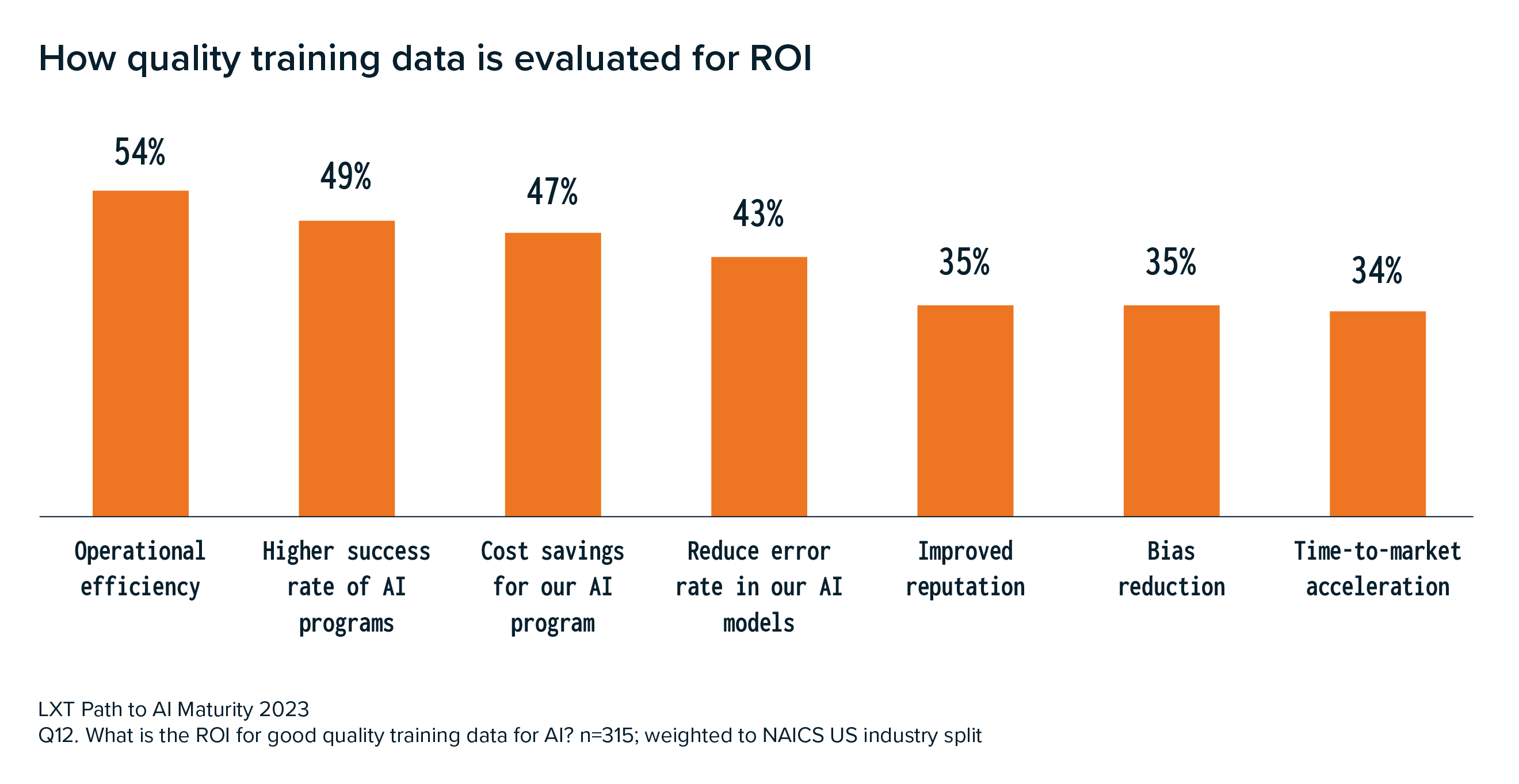

- Organizations say the greatest ROI of high-quality training data is found in operational efficiency.

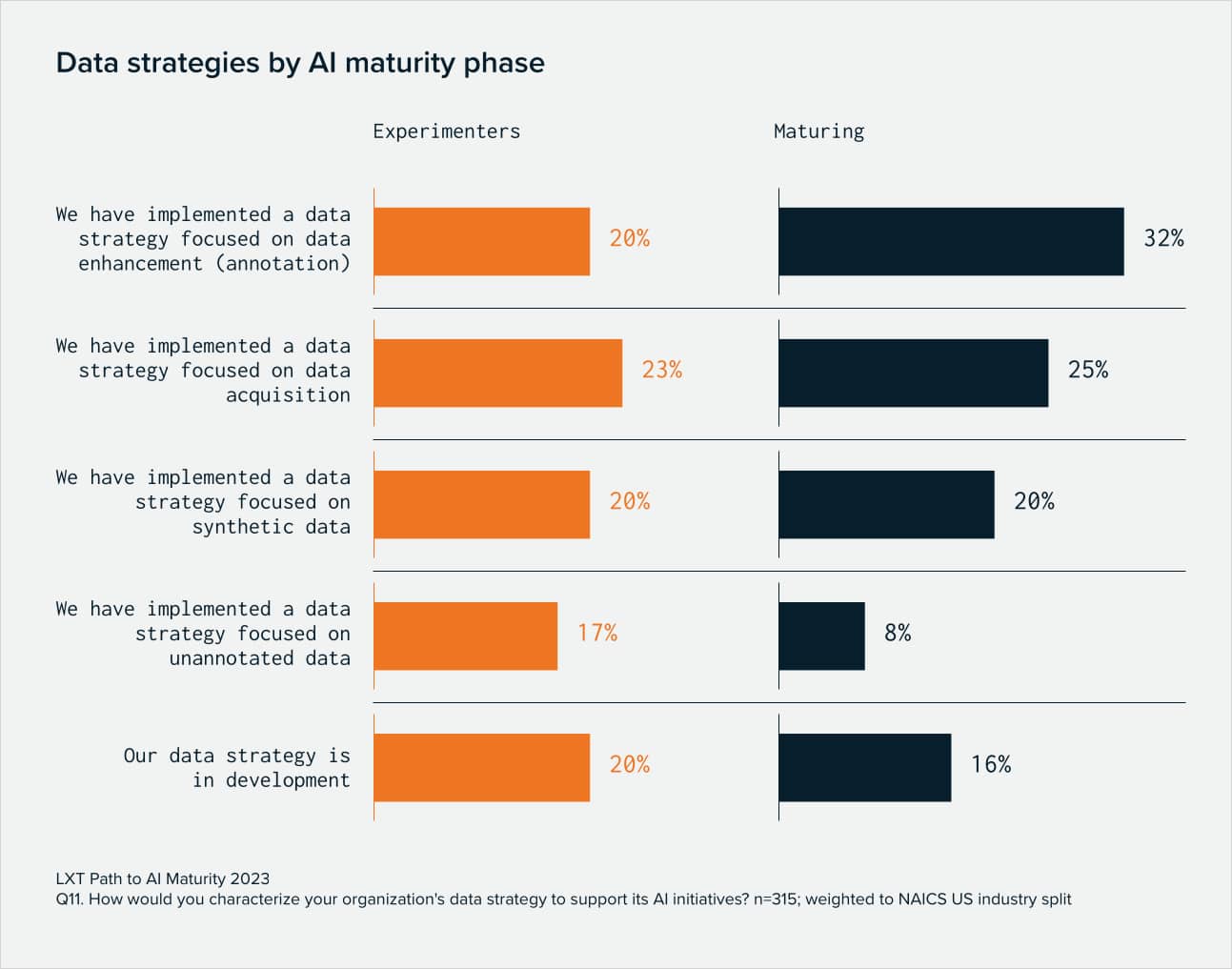

- Data strategies for maturing companies are focused on data enhancement.

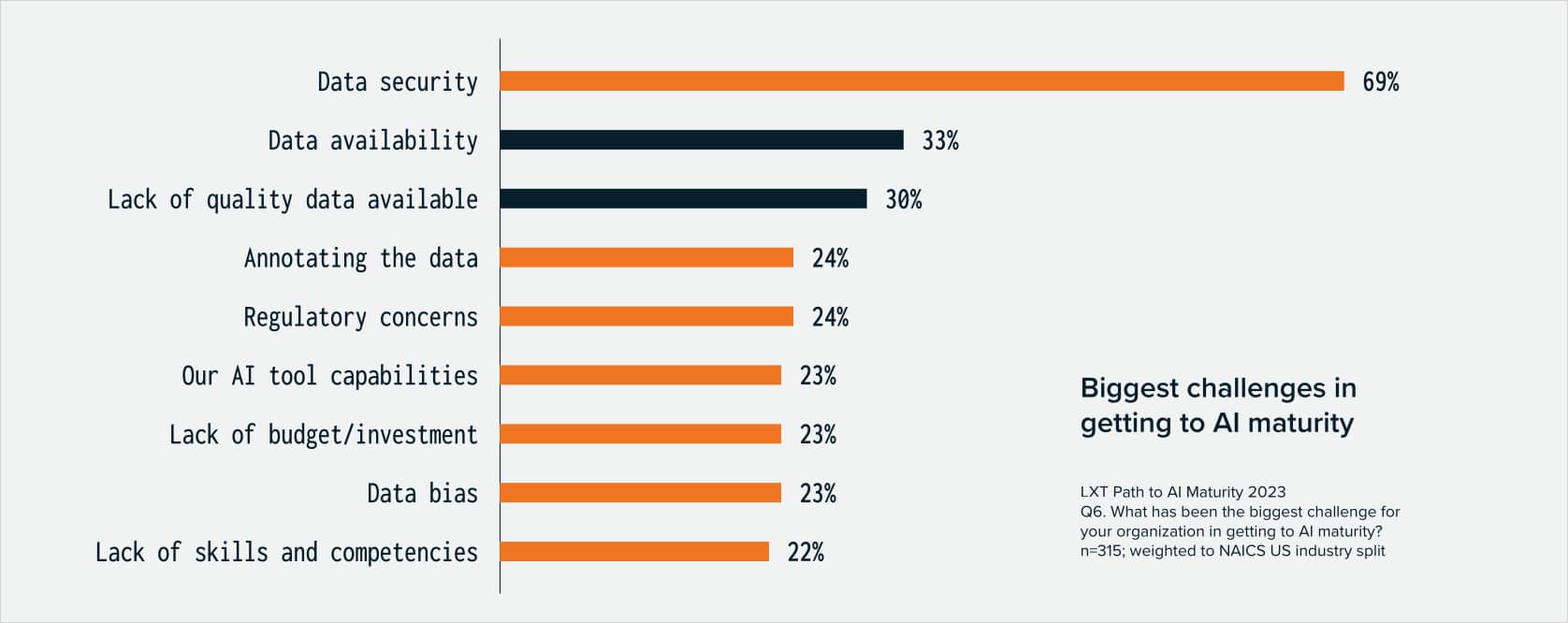

- Data security is the biggest challenge that organizations are facing when it comes to training data for AI.

- Most organizations (87%) say they are willing to spend more for higher-quality training data for AI.

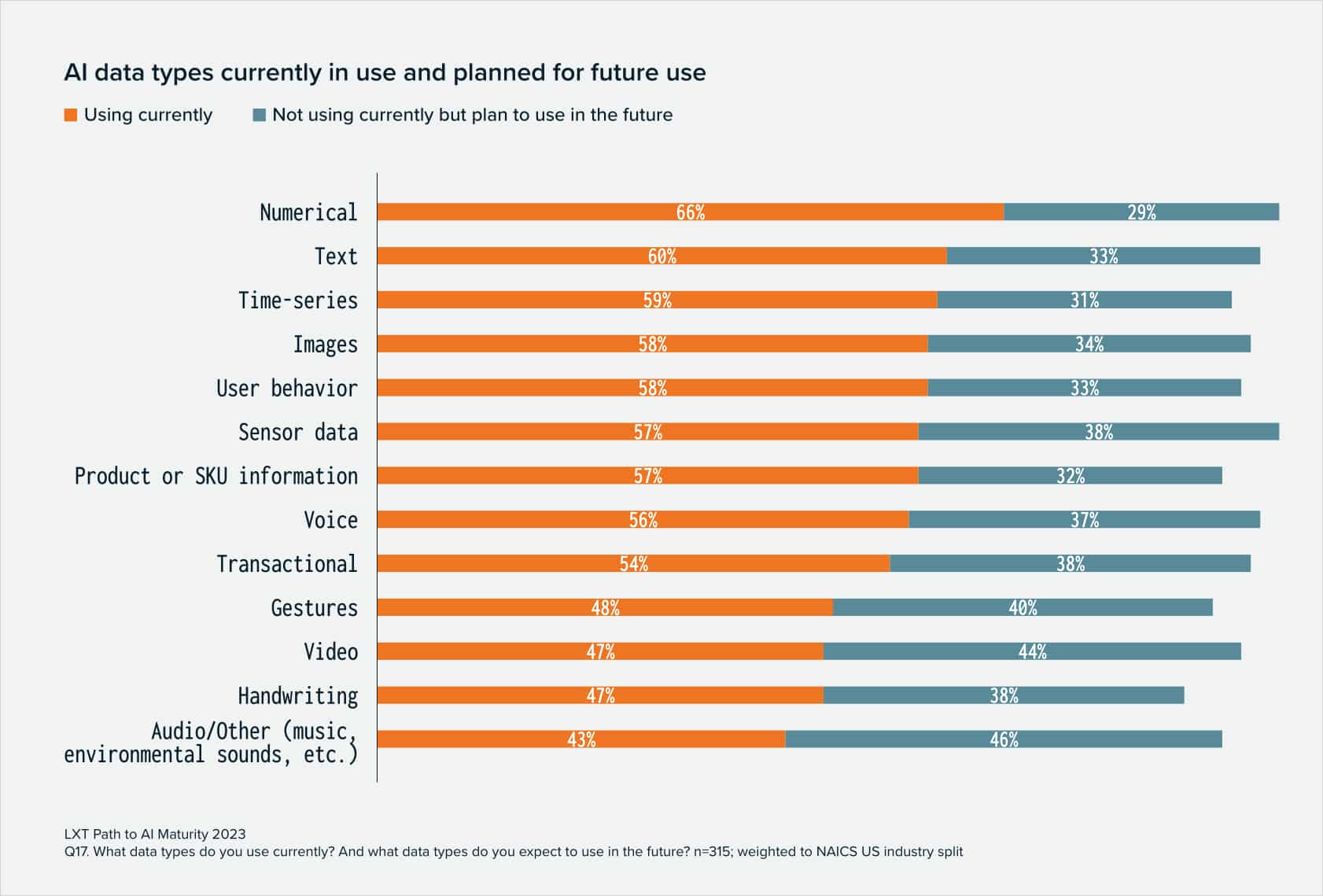

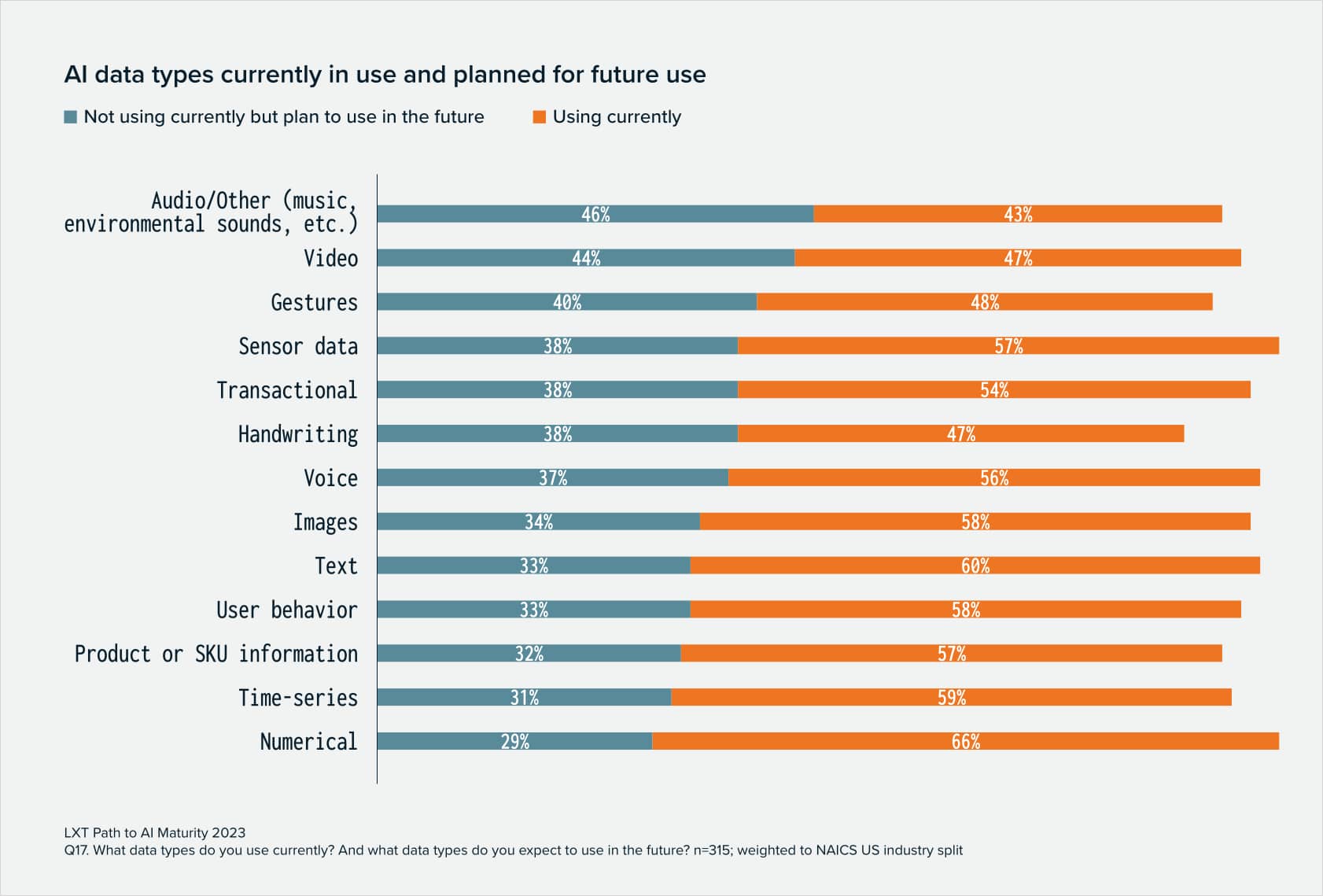

- The most highly used data type for the organizations surveyed is numerical data.

- Audio and video data are the data types that are most planned for future use.

Responsible AI

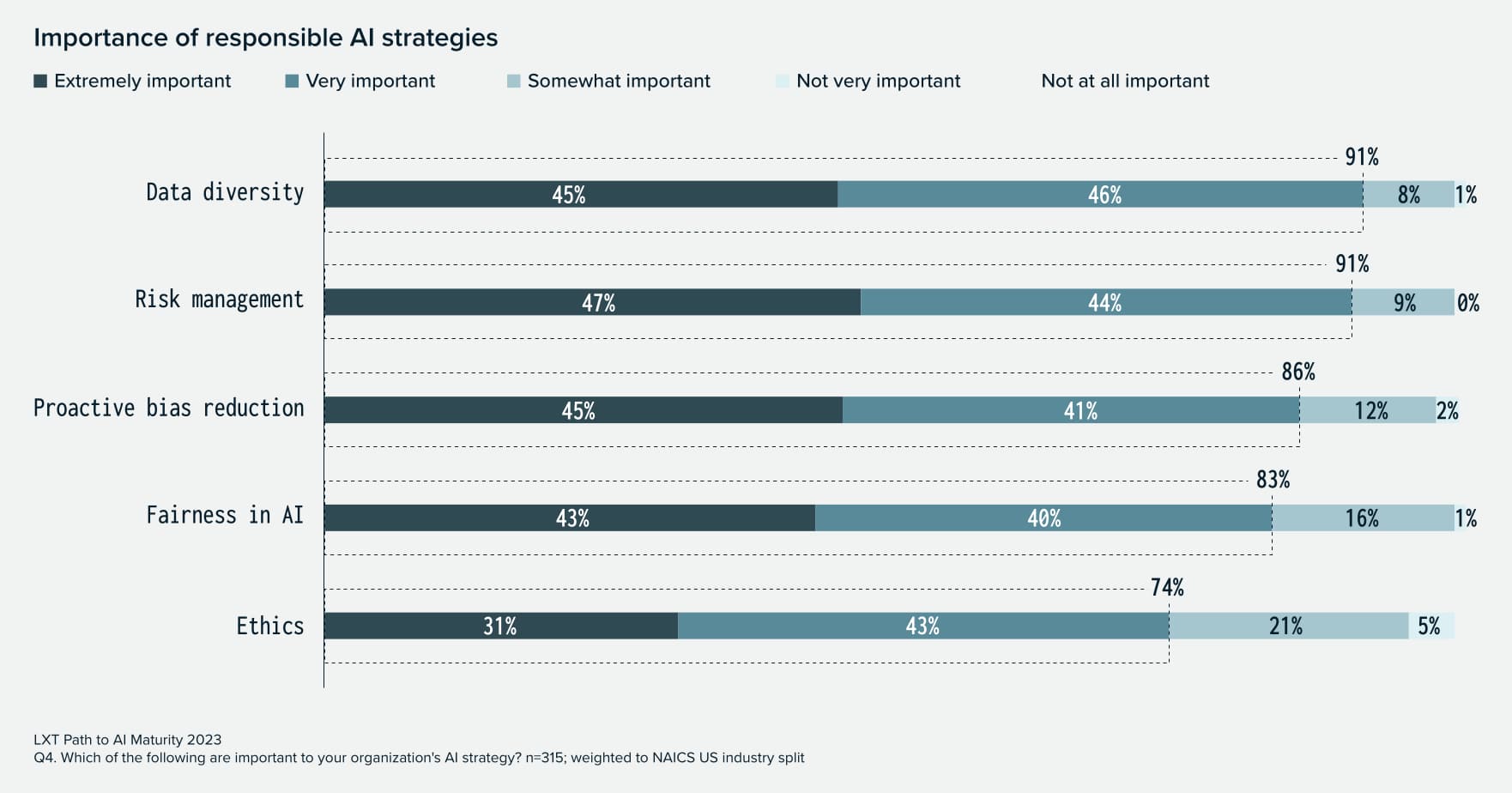

- Data diversity and risk management are important components of AI strategies

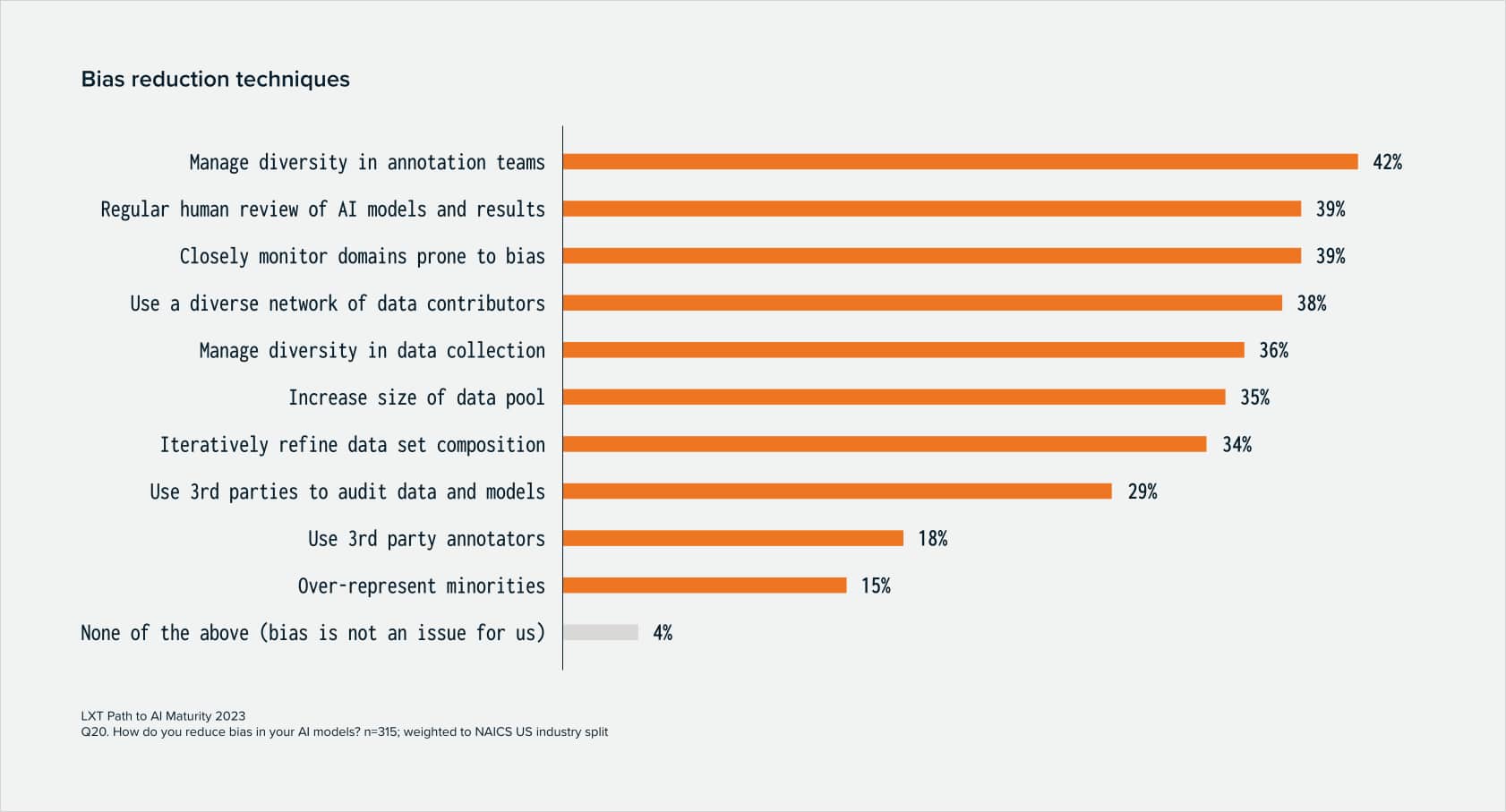

- Organizations rely on multiple strategies to reduce bias in AI models.

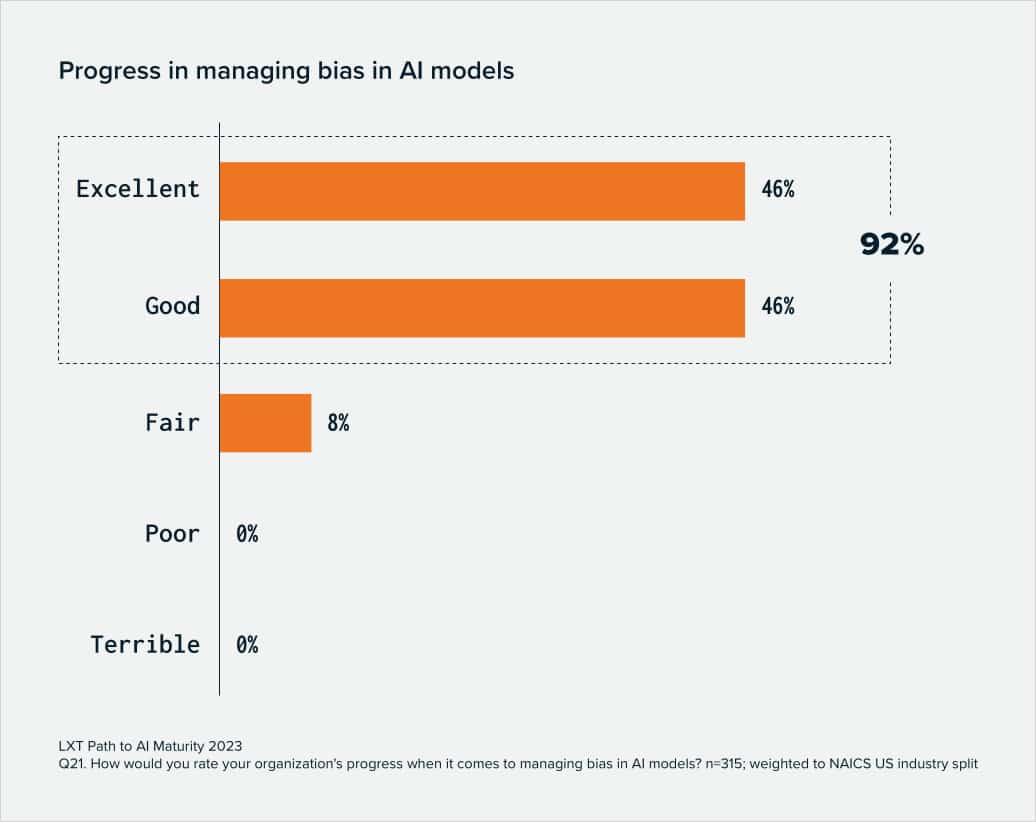

- Almost all organizations believe they have made excellent or good progress when it comes to managing bias in AI models.

AI trends by industry

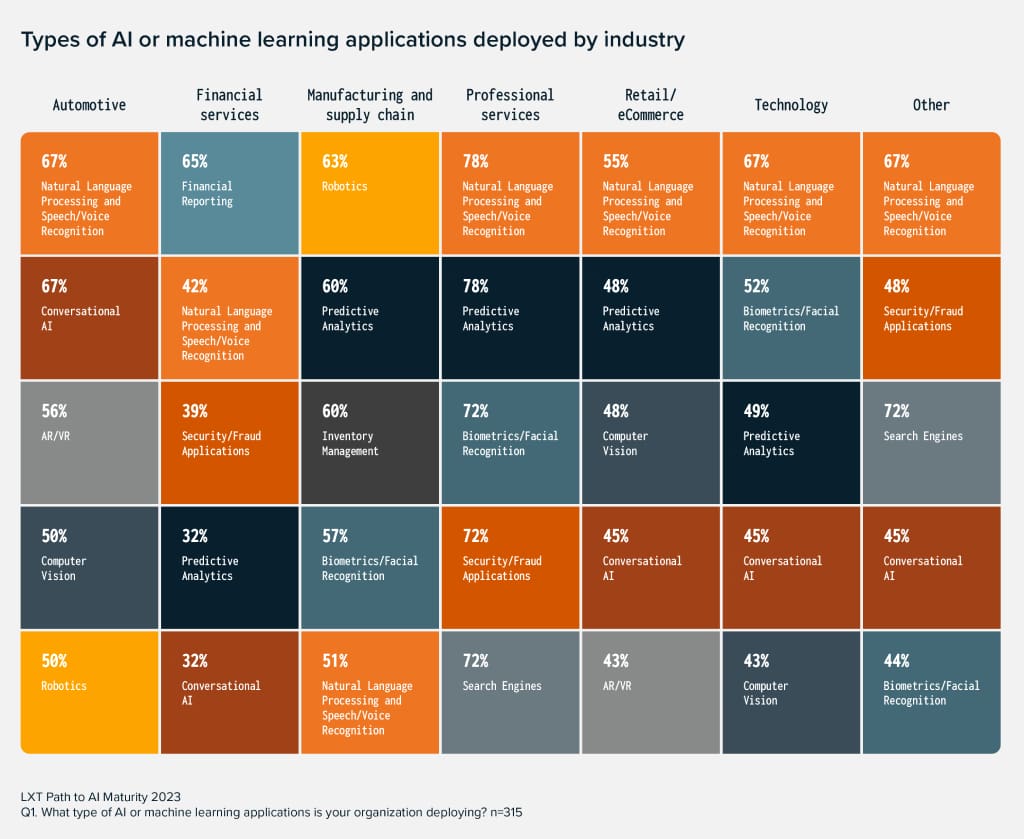

- NLP is the most deployed AI solution across industries.

- The manufacturing industry has the lowest AI project failure rate.

- Organizations in the professional services and manufacturing sectors are ahead in their AI journey.

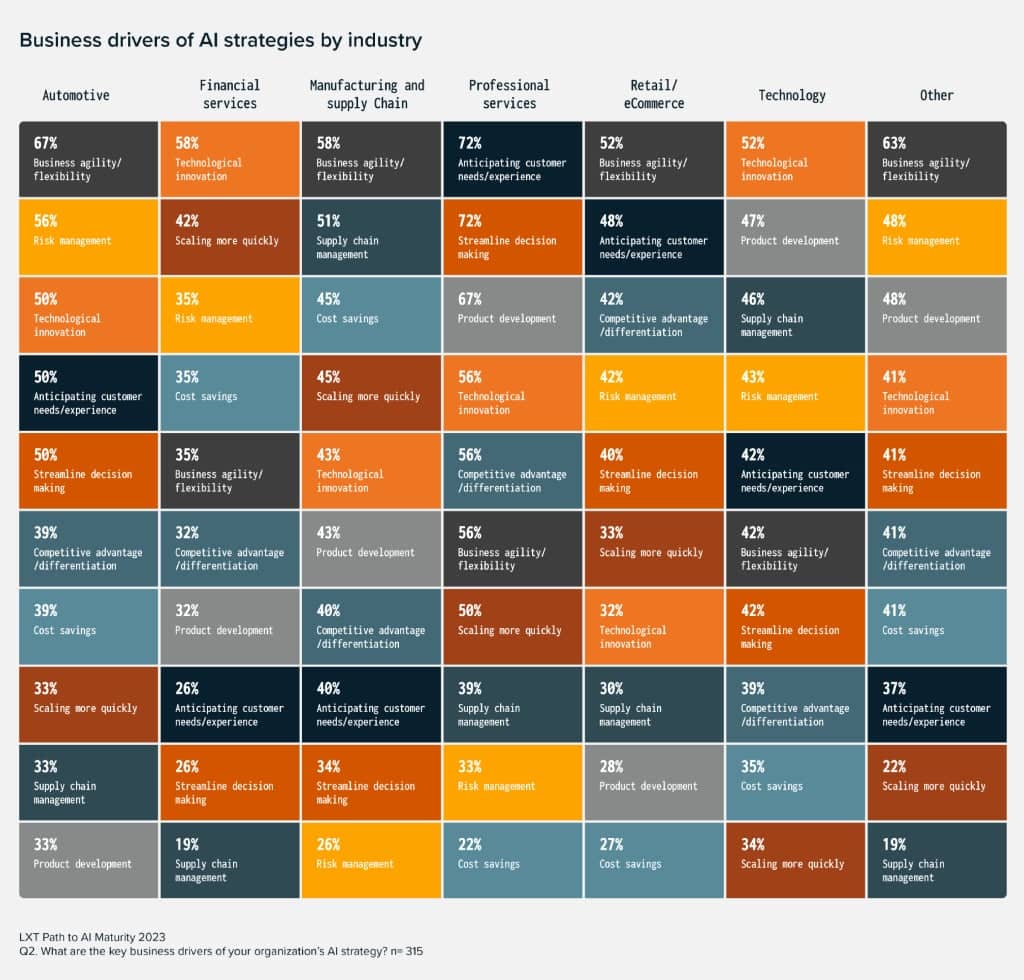

- Drivers of AI strategies vary by industry, with use cases in both customer-facing and internal functions.

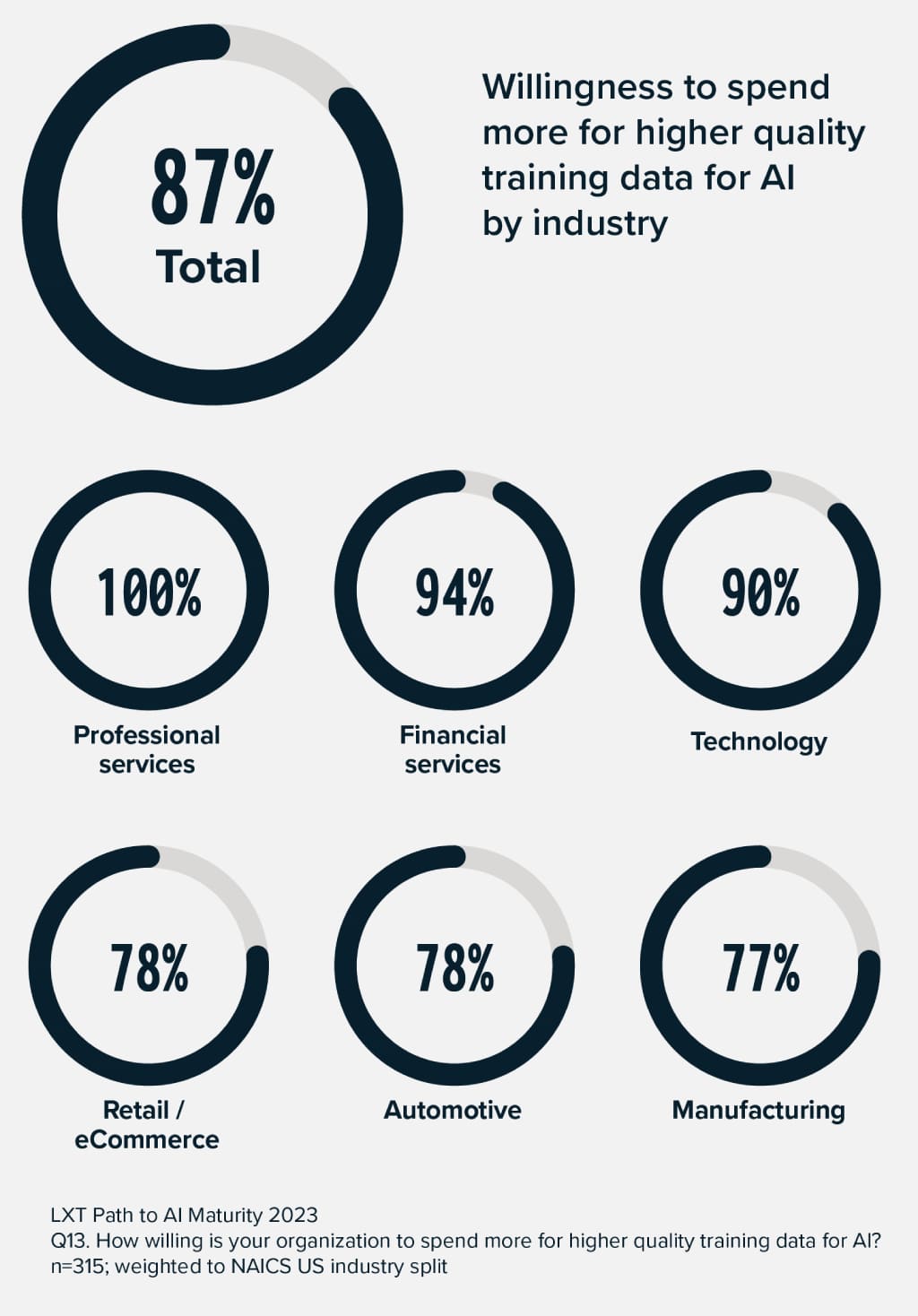

- The Professional Services industry is the most willing to spend more on higher-quality training data.

- Across industries, the majority of respondents are willing to pay more for higher-quality training data.

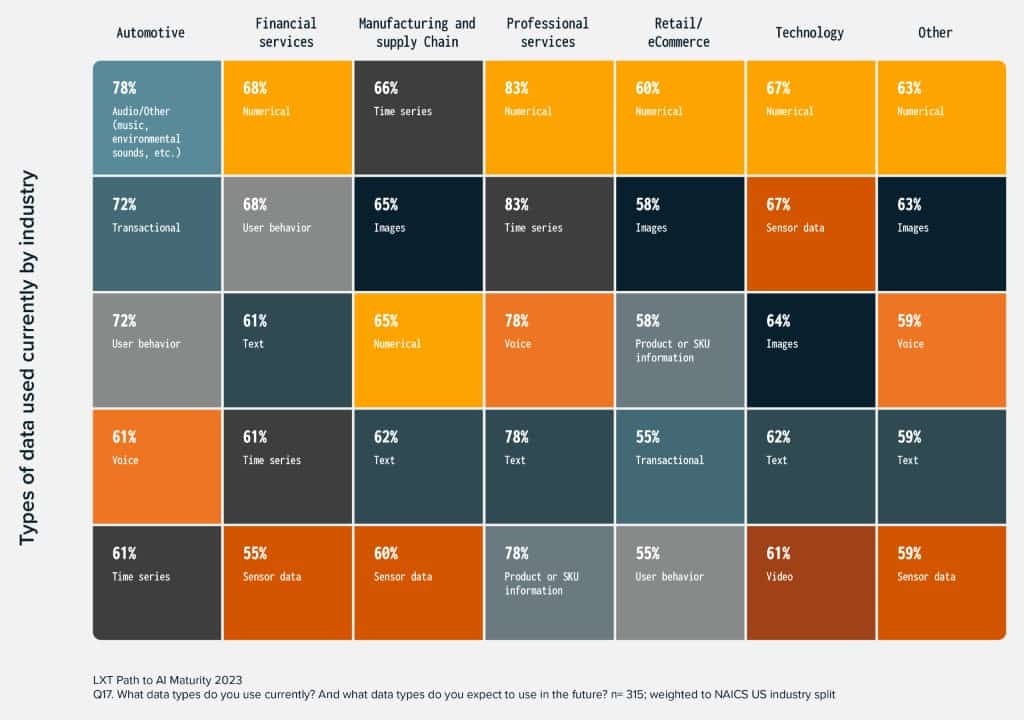

- Organizations across most sectors are predominantly using numerical data.

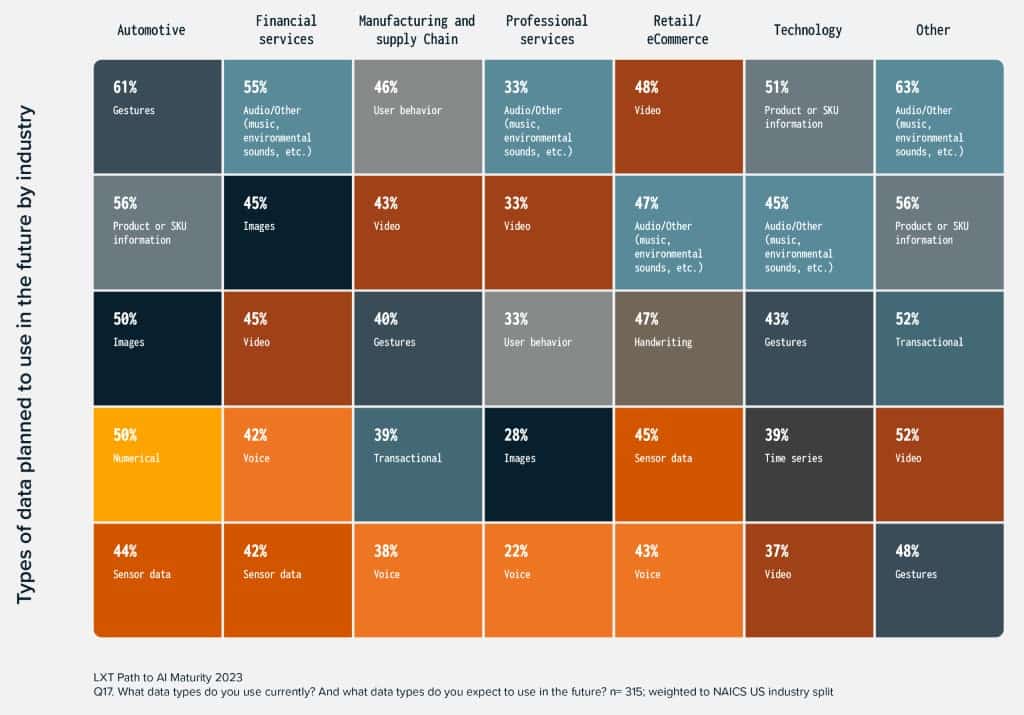

- The types of data planned for future use vary by industry.

01 AI Investment and Drivers

While the current economic climate is creating a high level of overall uncertainty, investment in AI continues to be strong as organizations view the technology as an important lever for business growth. Our study showed that close to half (49%) of organizations surveyed have AI budgets of $76M or more.

AI budgets correlate with an organization’s revenue

Not surprisingly, organizations with higher revenues have larger AI budgets. According to our study, the majority (58%) of high-revenue organizations have AI budgets over $75M. Only 25% of organizations with revenues of $500M or less have AI budgets over $75M.

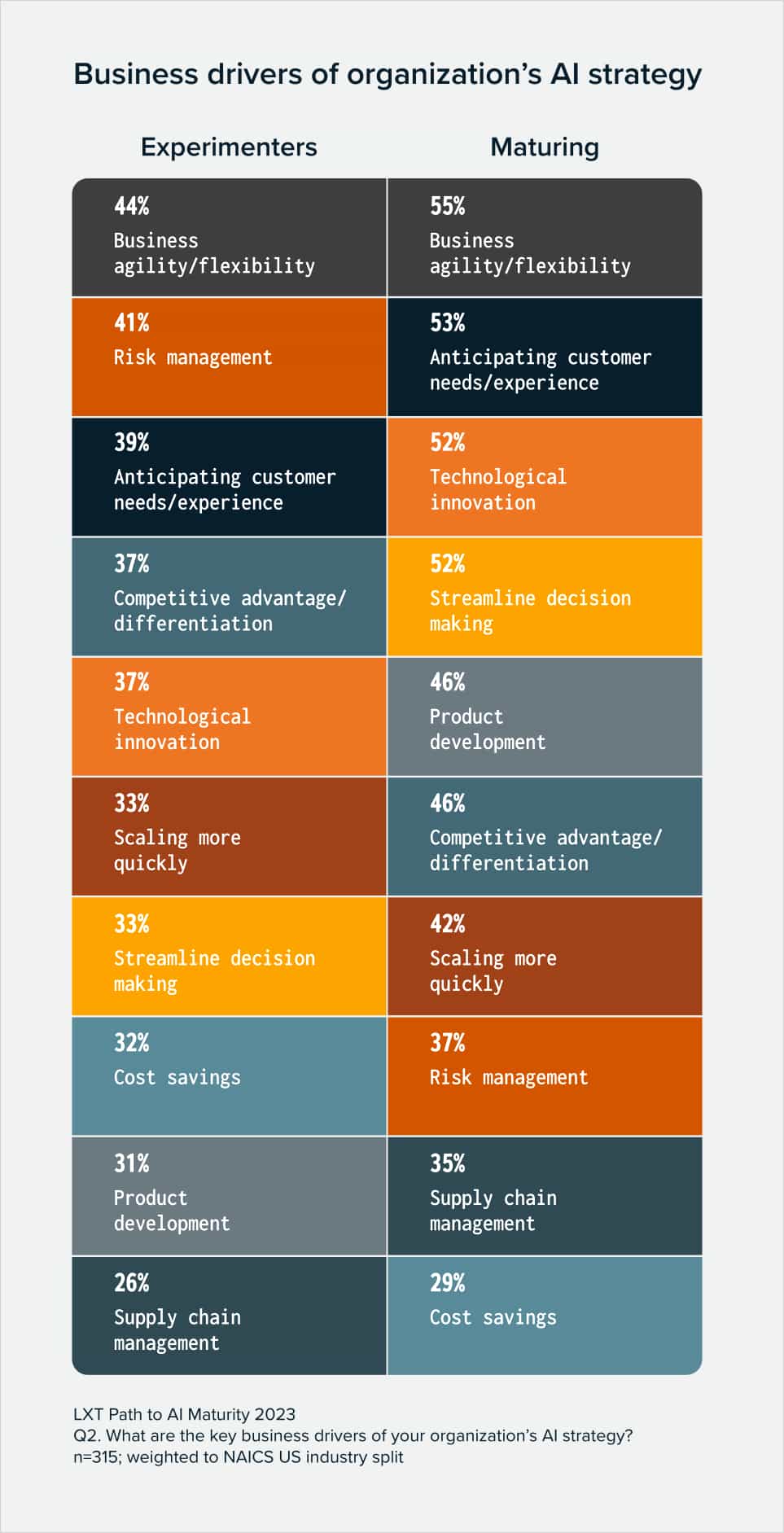

Business agility is the top driver of AI strategies

Organizations surveyed were given a variety of options to choose from when describing the drivers behind their AI strategies. Business agility and flexibility rose to the top amongst respondents, but solving for customer needs and supporting technological innovation were also top drivers for AI.

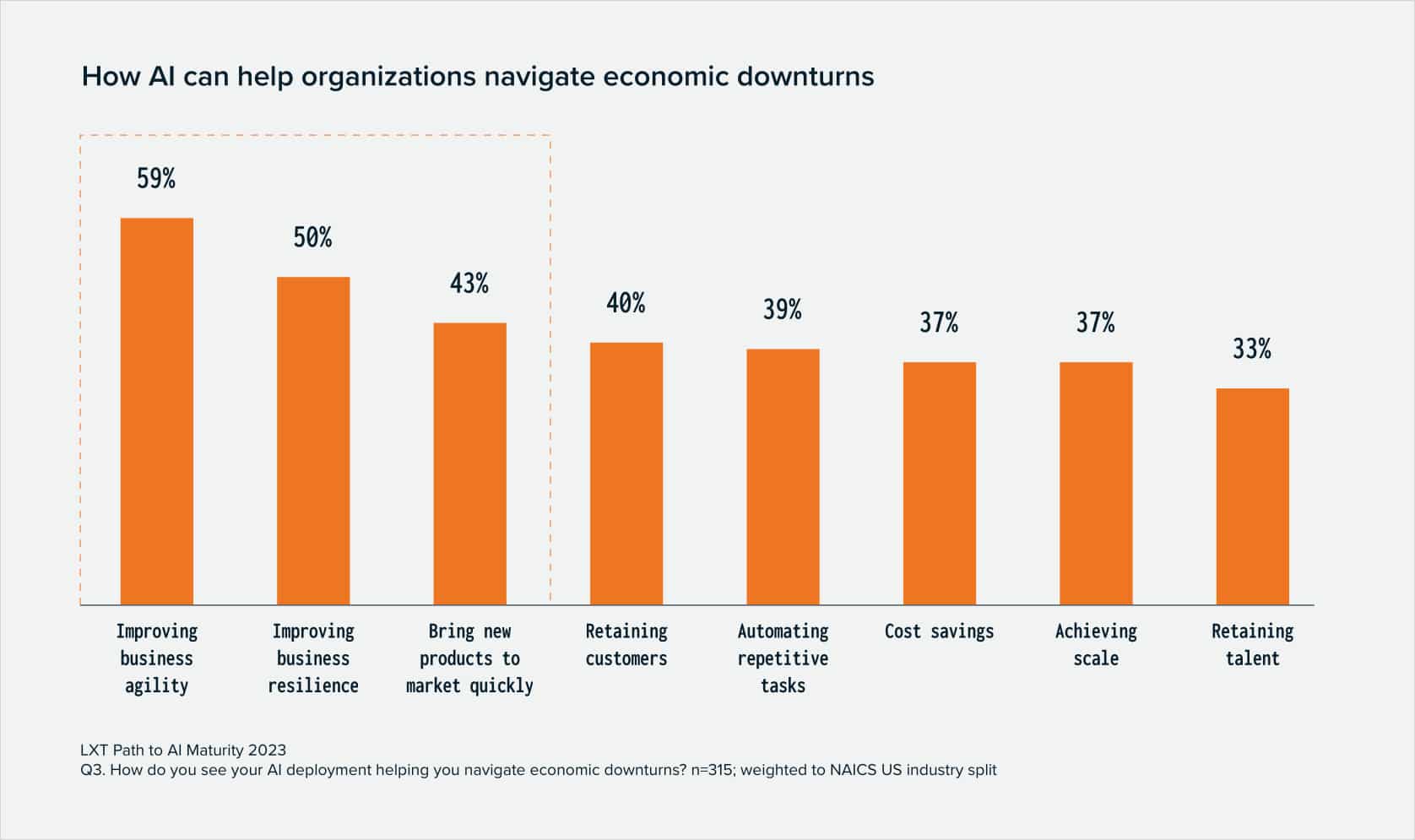

AI can help companies improve business agility during times of economic uncertainty

Given the current economic climate, we asked respondents to indicate how AI can help their organizations navigate economic downturns. Improving business agility and resilience as well as bringing new products to market quickly were the top benefits selected. Companies see AI as a way to help them quickly respond to market trends and drive innovation while simultaneously adjusting to disruptions that may occur due to external factors

NLP and Speech Recognition are the most commonly deployed AI applications

57% of survey respondents have deployed Natural Language Processing and Speech/Voice Recognition Systems. After NLP and Speech solutions, a wide range of solutions have been deployed including Predictive Analytics, Conversational AI and Computer Vision. This highlights the broad applicability of AI across industries.

Conversational AI solutions have delivered the highest return on investment

As part of the study we gave respondents the opportunity to tell us which AI applications they felt had delivered the highest return on investment for their organization to date. Conversational AI, Security Applications and NLP/Speech rose to the top, with respondents reporting a variety of solutions from Data Analytics to Inventory Management.

02 AI trends by maturity level

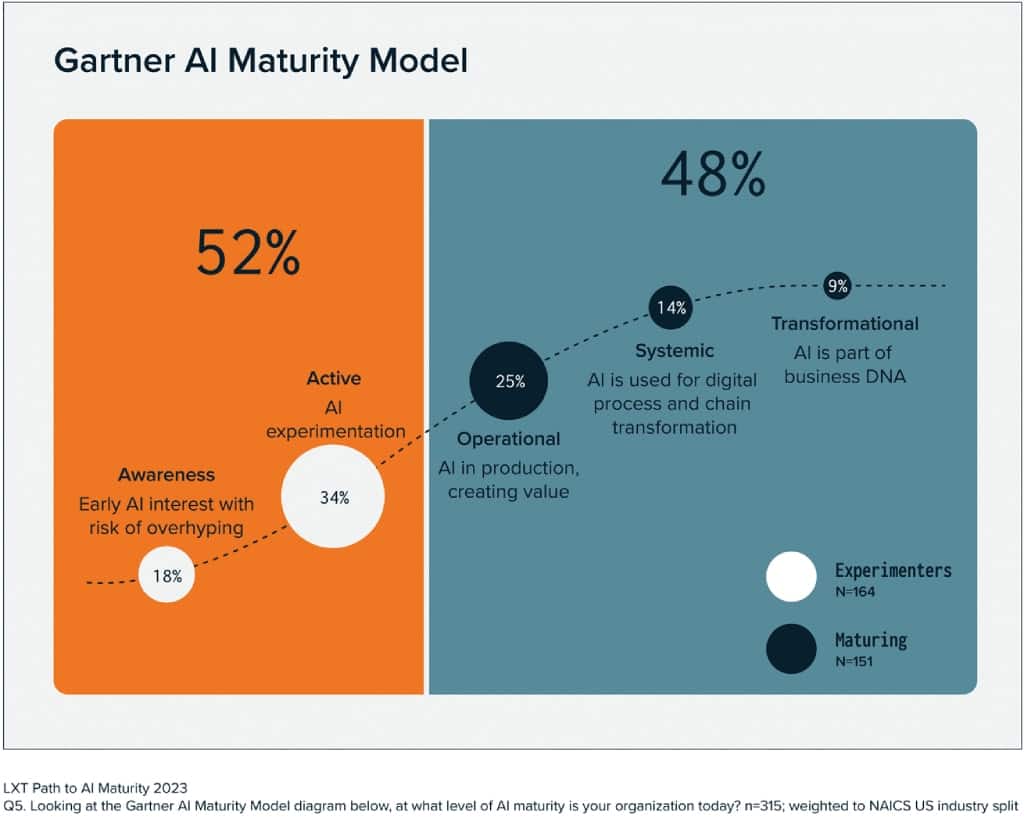

AI implementations continue to mature; close to half of organizations report having reached the higher levels of AI maturity

Gartner’s AI Maturity Model was used to gain insight into how respondents characterize the sophistication of AI implementations within their organizations. Survey participants were asked to select the level of AI maturity for their organization from one of the five Gartner AI Maturity Model levels.

- 25% - Operational: AI is in production, creating value

- 14% - Systemic: AI is used for digital process and chain transformation

- 9% - Transformational: AI is part of the business DNA

- 18% - Awareness: Early AI interest with risk of overhyping

- 34% - Active: AI experimentation

Maturing organizations are more likely to use AI to drive future advantage; Experimenters are more focused on risk management

When we examine the business drivers for AI by maturity stage, we find that while all companies most often selected business agility and flexibility as the main driver for their AI strategies, Maturing organizations are more focused on using AI to anticipate customer needs and improve the customer experience, along with driving technological innovation and streamlining decision making. Experimenters prioritize using AI to manage risk and create competitive advantage for their organizations.

In uncertain economic conditions, bringing new products to market quickly is seen as a significant benefit to Maturing companies

While all organizations see improving business agility and resilience as the top ways that AI can help them navigate economic downturns, Maturing companies say that AI will help them bring products to market quickly, while Experimenters rank this benefit the lowest. Experimenters believe that AI can help them navigate economic downturns by using the technology to retain customers and automate repetitive tasks.

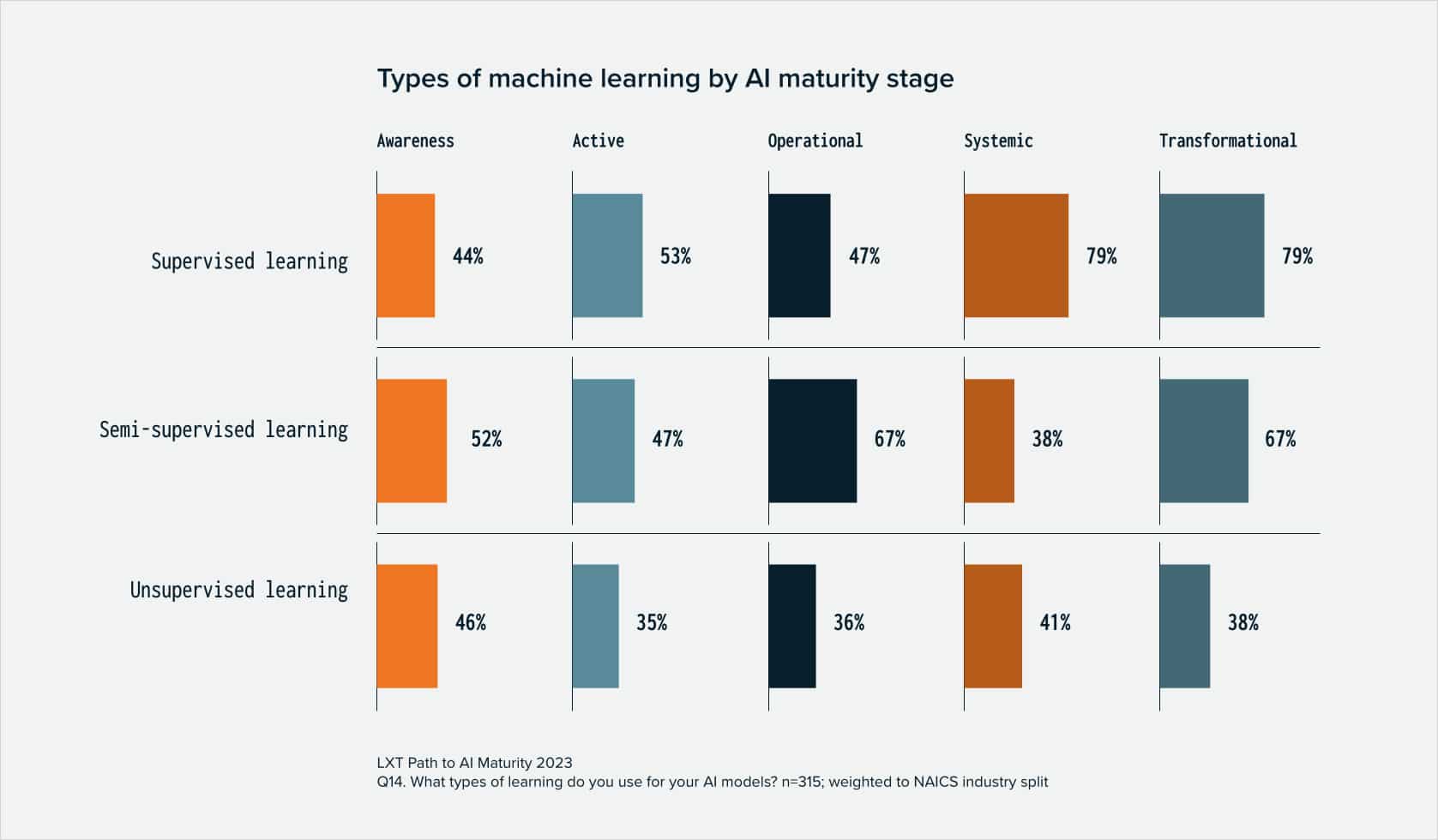

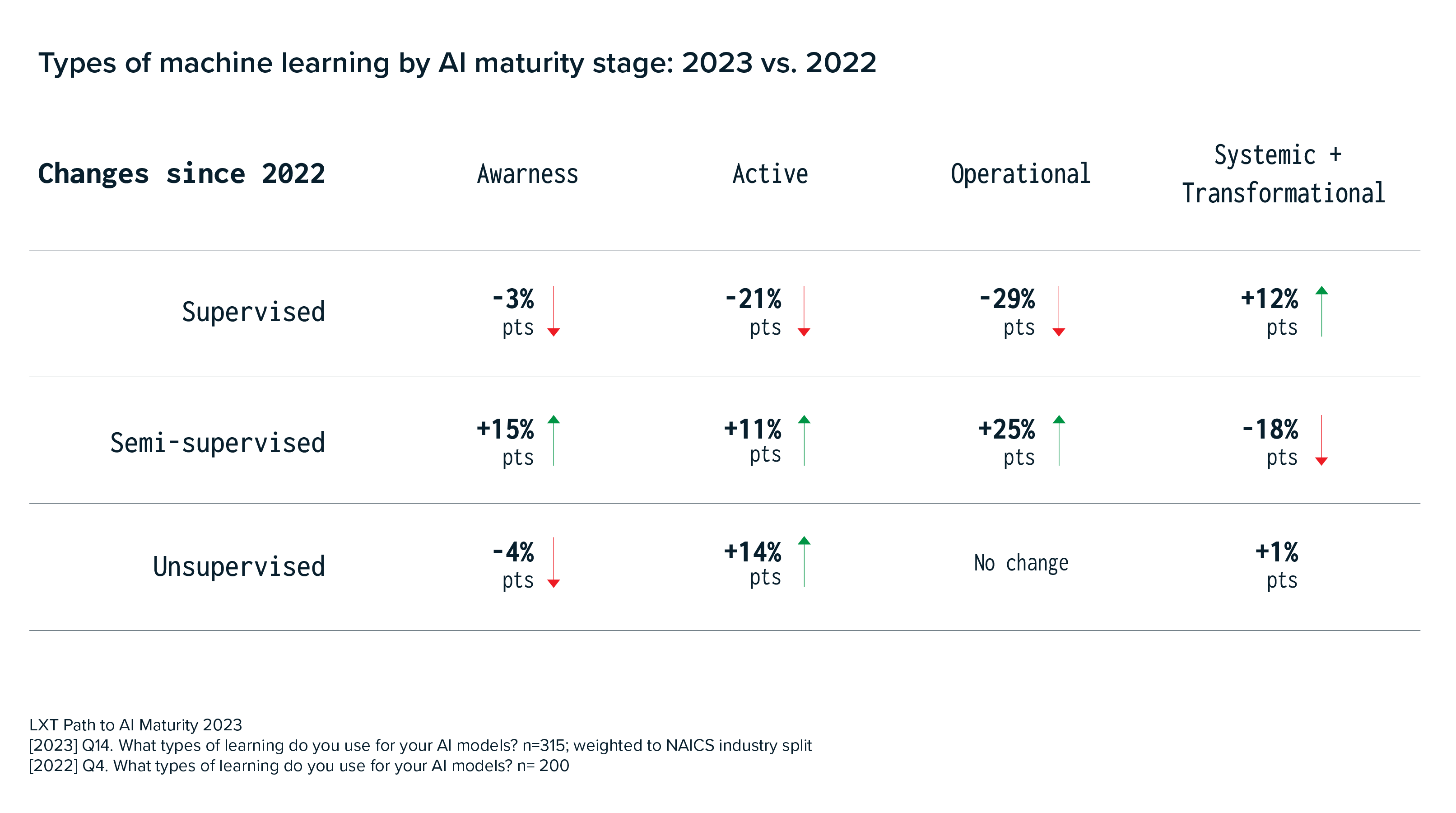

Companies that have reached the highest levels of AI maturity rely most on supervised machine learning methods

Survey respondents at the Systemic and Transformational levels of AI maturity use a combination of unsupervised, semi-supervised and supervised machine learning methods, but rely most on supervised machine learning which uses annotated data. Experimenters on the other hand use all three types of machine learning methods more evenly.

When we examine the machine learning methods used by AI maturity stage in the chart below, we see that companies that have reached the highest stages have shifted from using semi-supervised to supervised machine learning, which uses annotated or structured data. As organizations scale their AI deployments to extend into multiple areas of the business, they are relying on supervised learning in their AI maturity journey. While supervised learning requires more human input, this approach generally produces more accurate results.

For all other stages of AI maturity, companies are increasing their use of semi-supervised machine learning techniques which use a small amount of annotated data and a large amount of unannotated data for model training.

On average, 46% of AI projects failed to meet their goals, but the success rate increases as a company progresses in its AI maturity journey

While respondents state that the majority of AI projects meet their intended goals, 46% of AI projects have failed. However, as a company’s AI maturity moves from the Experimenter phase to the Maturity phase—or from pilot to production—AI project failure decreases from 55% to 36%. Building a reliable pipeline of high-quality training data can help improve project success rates by accelerating the move from pilot to production.

Integrating AI with existing technologies is the biggest barrier to reaching AI maturity

While integration of existing or legacy systems to AI is the biggest challenge to reaching AI maturity, additional hurdles exist across technology, people, data and resources. One quarter of organizations stated that getting management approval or buy-in was a top challenge to reaching AI maturity.

03 AI Data Trends

Over 80% of organizations have implemented a data strategy to support their AI initiatives

A high majority of organizations surveyed have invested in implementing a data strategy for AI. There is a close to even split between the percentage of organizations whose strategy is focused on data annotation versus data acquisition. 18% of companies are still developing their data strategy, which will be an important component to their success with AI.

The majority of organizations use annotated or synthetic data to train their machine learning models

While annotated data is the top choice for model training, synthetic data is also highly used. Unannotated data is used much less frequently by all the organizations surveyed.

The need for training data is high and will continue into the future

Two-thirds of respondents stated that their needs for training data will increase in the next two to five years. No respondents expect their training data expenditure to decrease in that timeframe. Organizations that have reached the highest level of maturity indicate the strongest need to increase their training data volumes over this time period. As companies deploy more AI models across their functions and business processes, more training data is needed to support initial model training and periodic model updates.

Training data for AI and product development account for the largest shares of AI budgets

When asked how an organization’s budget for AI is allocated across a range of categories, training data and product development ranked the highest. AI budgets have many components including strategy, talent, software and hardware with a fairly even distribution across them.

Organizations say the greatest ROI of high-quality training data is found in operational efficiency

When evaluating the ROI of high-quality training data to support their AI projects, organizations indicated various factors including operational efficiency, higher rates of success of AI projects and cost savings.

Data security is the biggest challenge that organizations are facing when it comes to training data for AI

Data security is currently by far the most challenging aspect for organizations when it comes to training data for AI. Companies are also struggling most when it comes to the availability and quality of their training data.

Most organizations say they are willing to spend more for higher-quality training data for AI

When asked if they would be willing to spend more for higher-quality data to support their AI initiatives, 87% agreed. No respondents indicated that they would not at all be willing to spend more for higher-quality data. Organizations understand the value of using high-quality training data as it helps them achieve higher accuracy and generate ROI faster.

The most highly used data type for the organizations surveyed is numerical data

Survey respondents indicated that numerical data was the data type most widely used for their AI applications. After text, there are many data types that are used fairly equally including time series, user behavior and sensor data.

Audio and video data are the data types that are most planned for future use

The mix of data types shifts when companies look to their future plans. Audio is the data modality most planned for future use, followed by video and gestures. Transactional data and handwriting also appear higher in the list for future data types.

04 Responsible AI

Given the increased focus on the topics of responsible and ethical AI, we took the opportunity to ask respondents a few questions about these important topics.

Data diversity and risk management are important components of AI strategies

When asked about a variety of themes related to building responsible AI, data diversity and risk management were equally important. Proactive bias reduction was also an important theme, followed by fairness in AI and ethics. A high majority of respondents indicated that these strategies are important aspects of their AI strategies, showcasing the importance of building responsible AI in today’s world.

Organizations rely on multiple strategies to manage bias in AI models

Managing diversity in annotation teams, regular human reviews of AI models and results, and closely monitoring domains prone to bias are the top three strategies used to manage bias in AI models. Only 4% of organizations say bias is not an issue. We are encouraged to see the range of strategies being used by organizations to manage bias, and that organizations are implementing multiple strategies to tackle this issue.

Almost all organizations believe they have made excellent or good progress in managing bias in AI

When it comes to managing bias in AI, the results were very positive. 92% stated that they believe they have made good or excellent progress. Organizations are aware that bias is an issue that they need to actively address which is a positive step towards the goal of building more responsible and inclusive AI solutions.

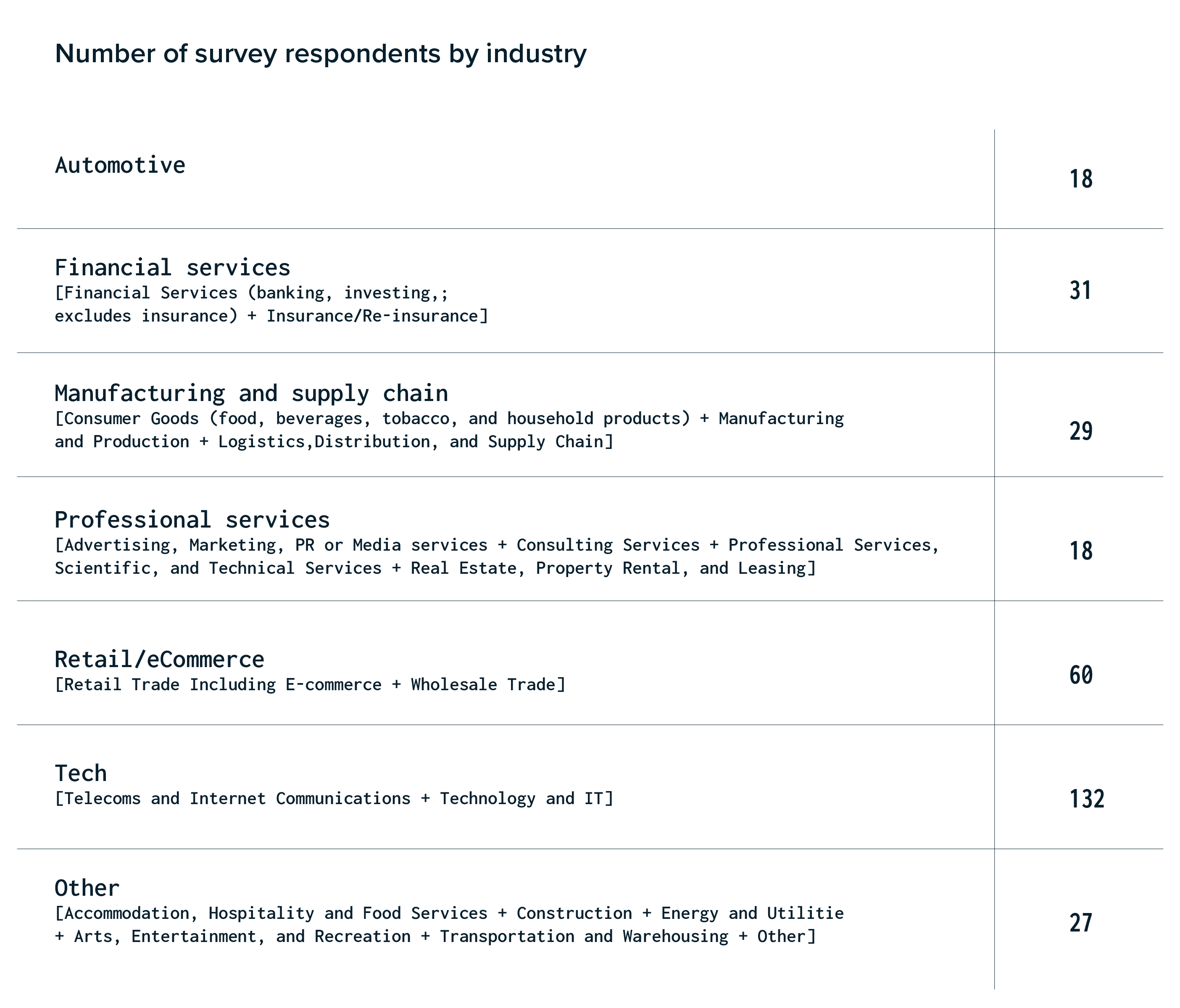

05 AI Trends by Industry

Survey respondents represent the views of organizations across a range of industries, from automotive to retail to financial services. Following are some of the key findings by industry segment.

NLP is the most deployed AI solution across industries

NLP and Speech applications have been deployed the most in the automotive, technology, retail/eCommerce and professional services industries. The only industries in our survey where NLP and Speech applications were not the most deployed were financial services and manufacturing, however NLP and Speech was the second most deployed application in financial services. NLP is used across a wide range of solutions from search engines to chatbots to social media monitoring and more, and allows organizations to analyze large volumes of data to gain insights, streamline their processes and connect with customers. Generative AI — where entirely new content is generated using AI models — is unlocking a host of new opportunities for NLP models to generate new content that is grammatically correct and at the same time engaging, but human oversight is needed to ensure content accuracy and to manage potential bias.

While over half of manufacturing companies surveyed have deployed NLP solutions, this industry is more focused on deploying predictive analytics, robotics and inventory management solutions.

The manufacturing industry has the lowest AI project failure rate

AI project failure rates vary widely by industry, with the highest failure rates being reported in retail/eCommerce and financial services. The manufacturing and professional services industries report the lowest failure rates for AI projects.

Organizations in the professional services and manufacturing sectors are ahead in their AI journey

Building on the previous finding where the manufacturing and professional services industries report the lowest failure rates for AI projects, these industries are also the furthest ahead in their AI journey according to their own assessment of where their company sits on the Gartner AI Maturity Model.

Drivers of AI strategies vary by industry, with use cases in both customer-facing and internal functions

While business agility and flexibility are key drivers of AI strategies for several industries represented in the survey, technological innovation rises to the top for both the financial services and technology industries. Professional services’ use of AI is driven equally by anticipating customer needs and streamlining decision making. The chart below shows that AI is being used externally to drive innovation, as well as internally through risk management streamlining decision making.

The professional services industry is the most willing to spend more on higher-quality training data

When asked if they are willing to spend more for higher quality training data, 100% of respondents in the professional services industry agreed, and a large majority of respondents across all other industries agreed as well.

Organizations across most sectors are predominantly using numerical data

While numerical data is the type of data most commonly used in the Financial Services, Professional Services, Retail/ eCommerce and Technology sectors, Automotive is using audio data and Manufacturing is using time series data the most. Images and numerical data are also high on the list for Manufacturing.

The types of data planned for future use vary by industry

When respondents were asked about the types of data they plan to use in the future, we saw more variance across industries. Audio and video data were top choices across most industries except for Automotive that is considering gesture data the most, and Manufacturing that is considering user behavior data the most.

Conclusion

The release of ChatGPT at the end of 2022 was a watershed moment for Artificial Intelligence, creating a wide-spread frenzy in the market and highlighting the massive impact of a single AI application across all industries. The potential disruption that AI applications can generate is fueling continued and significant investment in the technology.

Our research revealed how organizations view AI as an important tool to help improve their agility during times of economic uncertainty. Companies that have reached the highest levels of AI maturity have embedded artificial intelligence across their organizations to transform the way they do business.

We also found that an increasing number of companies have moved past the Active stage into the higher levels of AI maturity, where they now believe they are generating a solid return on their investments.

Through our research we discovered that AI-maturing organizations:

Are more likely to use AI to drive future advantage

While companies across all stages are using AI to drive business flexibility and agility, our research showed that Maturing companies are more focused on using AI to anticipate customer needs and support innovation, while managing risk is more important to Experimenters.

See higher success rates with their AI projects

Experimenters stated that 55% of their AI projects have failed, but failure rates decrease to 36% in the Maturing stage. As companies gain more experience with AI and clarify their objectives in AI projects, they see improved success rates and higher returns on their investments.

Rely most on supervised machine learning methods

AI Maturing organizations use a combination of supervised, semi-supervised and unsupervised machine learning techniques. They use supervised machine learning the most and are increasing their usage of semi-supervised learning year over year.

Implement data strategies focused on data enhancement

It is encouraging to see that over 80% of organizations surveyed have implemented a data strategy. AI is a data-driven technology, so creating a data strategy to support AI projects is critical to their success. AI Maturing companies have most often implemented data strategies focused on data enhancement or annotation, followed by acquisition.

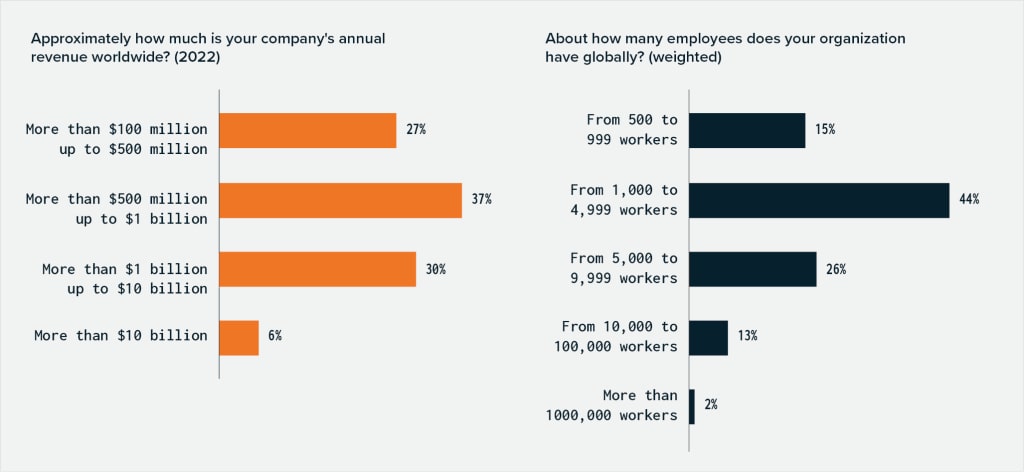

Behind the research

LXT commissioned a survey of 315 senior decision-makers working for US organizations. 46% of respondents were from the C-Suite and all those who took part had verified AI experience; only 25% of those who applied met the criteria required for participation, which included their level of AI knowledge and experience.

Contributors were engaged using online surveys, answering on behalf of a range of business sizes, revenues and industries. Each participant represents a US organization with at least $100 million in annual revenue and over 500 employees.

The results were weighted to match the North American Industry Classification System split of companies with 500+ employees in an effort to reflect an accurate representation of the mix of US companies by industry.

The research was conducted from September 29th to October 21st, 2022, by Reputation Leaders, an independent research organization. Interviews were conducted in the US by online survey using the panel services of Borderless Access.

For questions about the research findings, please reach out to us at info@lxt.ai.

About LXT

LXT is an emerging leader in AI training data to power intelligent technology for global organizations. In partnership with an international network of contributors, LXT collects and annotates data across multiple modalities with the speed, scale and agility required by the enterprise.

Our global expertise spans more than 145 countries and over 1000 language locales. Founded in 2010, LXT is headquartered in Canada with presence in the United States, UK, Egypt, India, Turkey and Australia. The company serves customers in North America, Europe, Asia Pacific and the Middle East.

Learn more at lxt.ai.