The ROI of High-Quality AI Training Data 2023

Introduction

Just seven months ago we saw the release of ChatGPT, a transformational generative AI tool that has taken the larger business and technology industry by storm. It has spurred a frenzy of additional generative AI applications and the integration of the technology into leading platforms. This will have huge implications for the way organizations approach their AI strategy and investments into the future.

Our Path to AI Maturity research shows that even before the shockwave-like launch of ChatGPT, natural language processing (NLP) and conversational AI (CAI) were two of the top three most widely deployed AI applications. The range of AI applications is large - everything from predictive analytics to security and robotics - which highlights the wide applicability of AI, and now generative AI, across the enterprise.

Conversational AI and natural language processing were also at the top of the list of AI applications to deliver ROI in the enterprise, which may be due in part to being more widely deployed. The rise of generative AI has turbo-charged these applications and their potential ROI.

What is fueling those deployments? Enterprises are using CAI to build chatbots, digital assistants and other automated interfaces that allow them to connect with customers, build relationships and reduce costs. They are taking advantage of natural language processing and speech/voice recognition technologies to unlock the potential of their language data for use cases that include knowledge management, sentiment analysis, contract reviews and more.

Earlier this year, LXT published its second annual report: “The Path to AI Maturity”. The report summarizes the findings of LXT’s survey of 315 senior executives from a variety of industries with artificial intelligence (AI) experience at mid-to-large US organizations. Two-thirds of respondents were C-Suite executives.

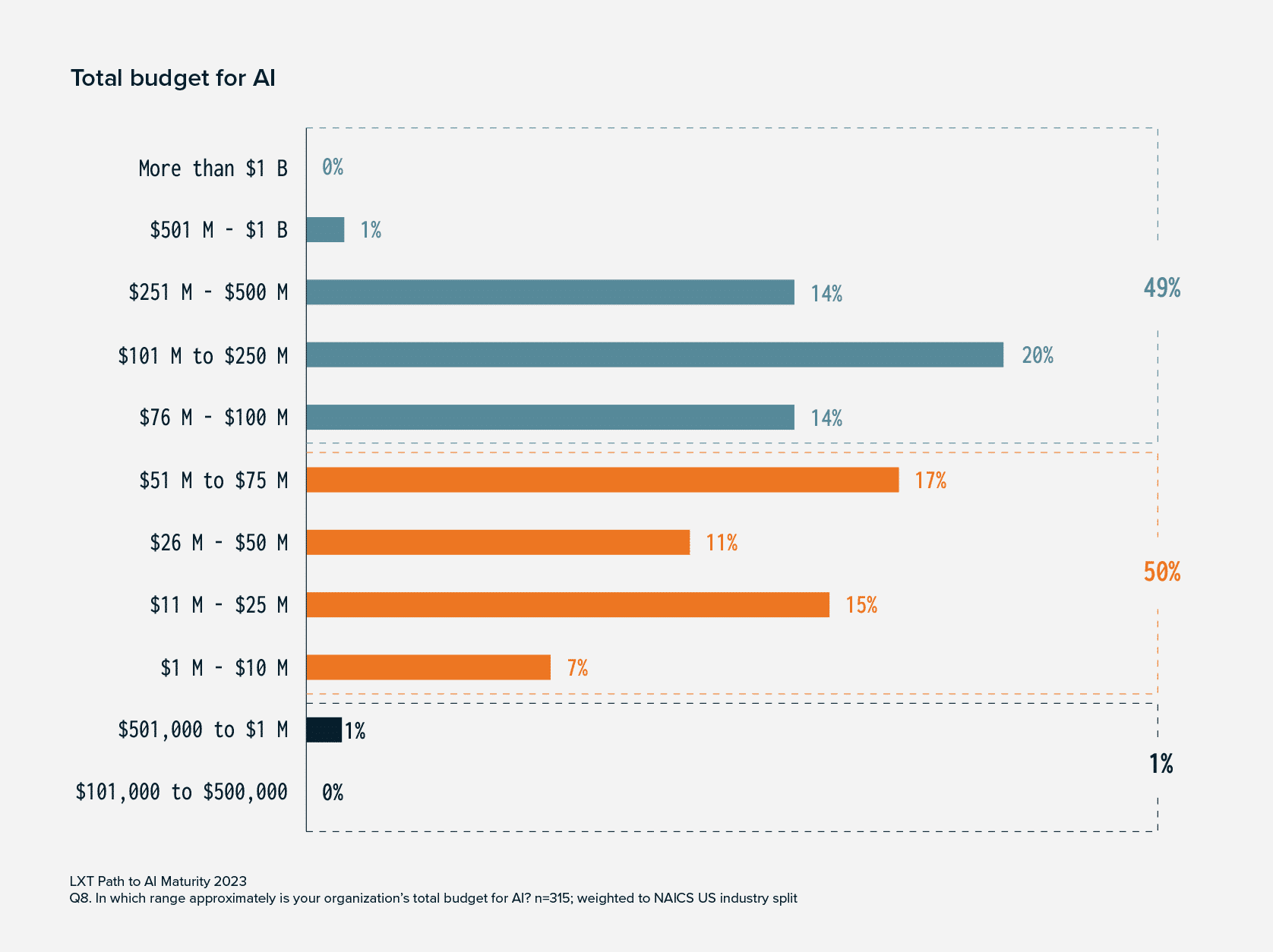

This year’s report revealed increased levels of AI investment despite the general downturn in the economy, and a greater proportion of organizations assessing themselves as operating at higher levels of AI maturity. The findings also show that amidst the current macroeconomic conditions, business agility has come to the forefront as a driver of AI strategy.

In today’s climate, companies are increasingly evaluating their investments to determine which ones are driving value. This follow-on report from the same research study provides a view into how enterprises evaluate the return on investment of the training data that fuels their AI projects, and how they value these investments.

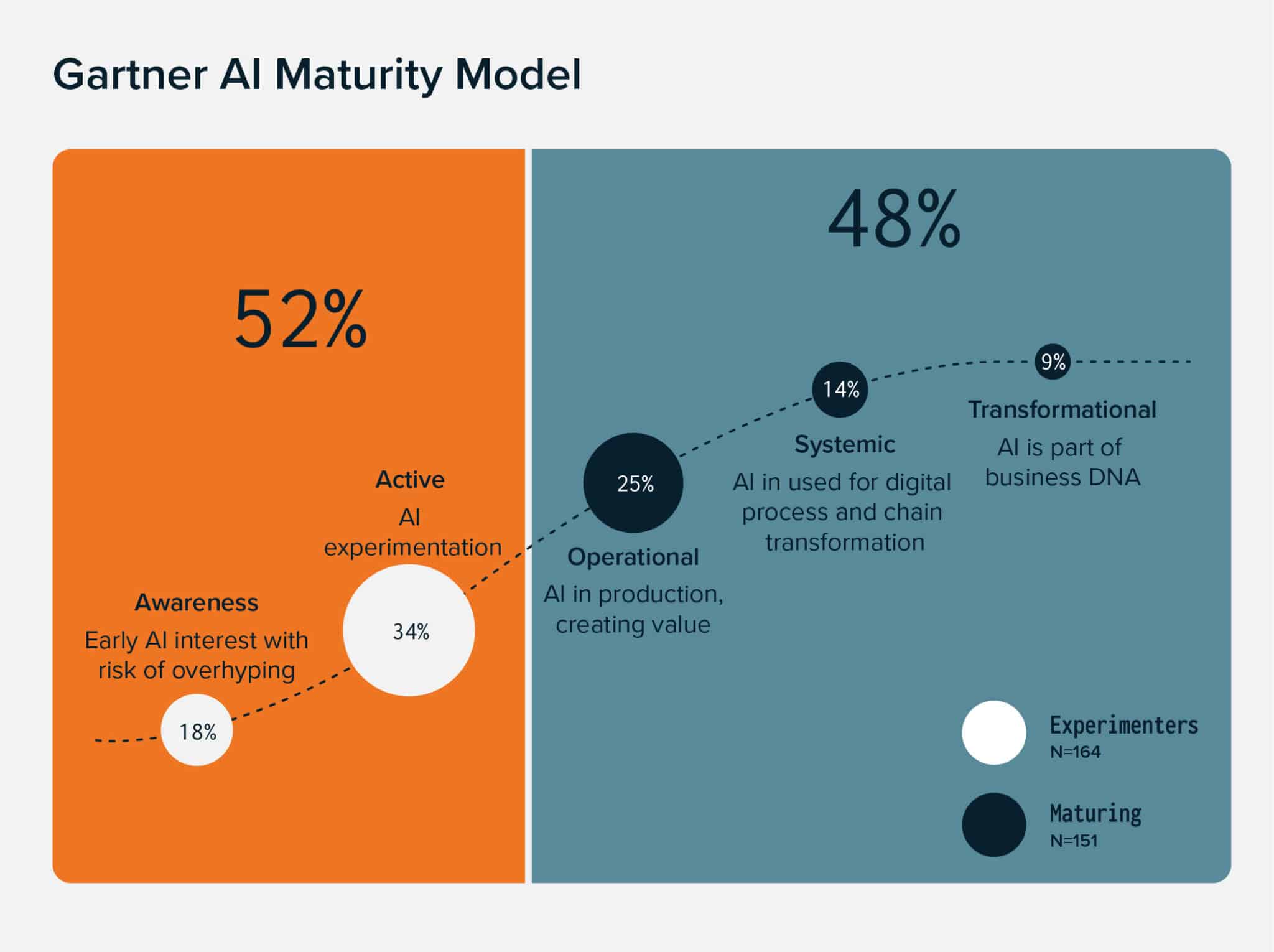

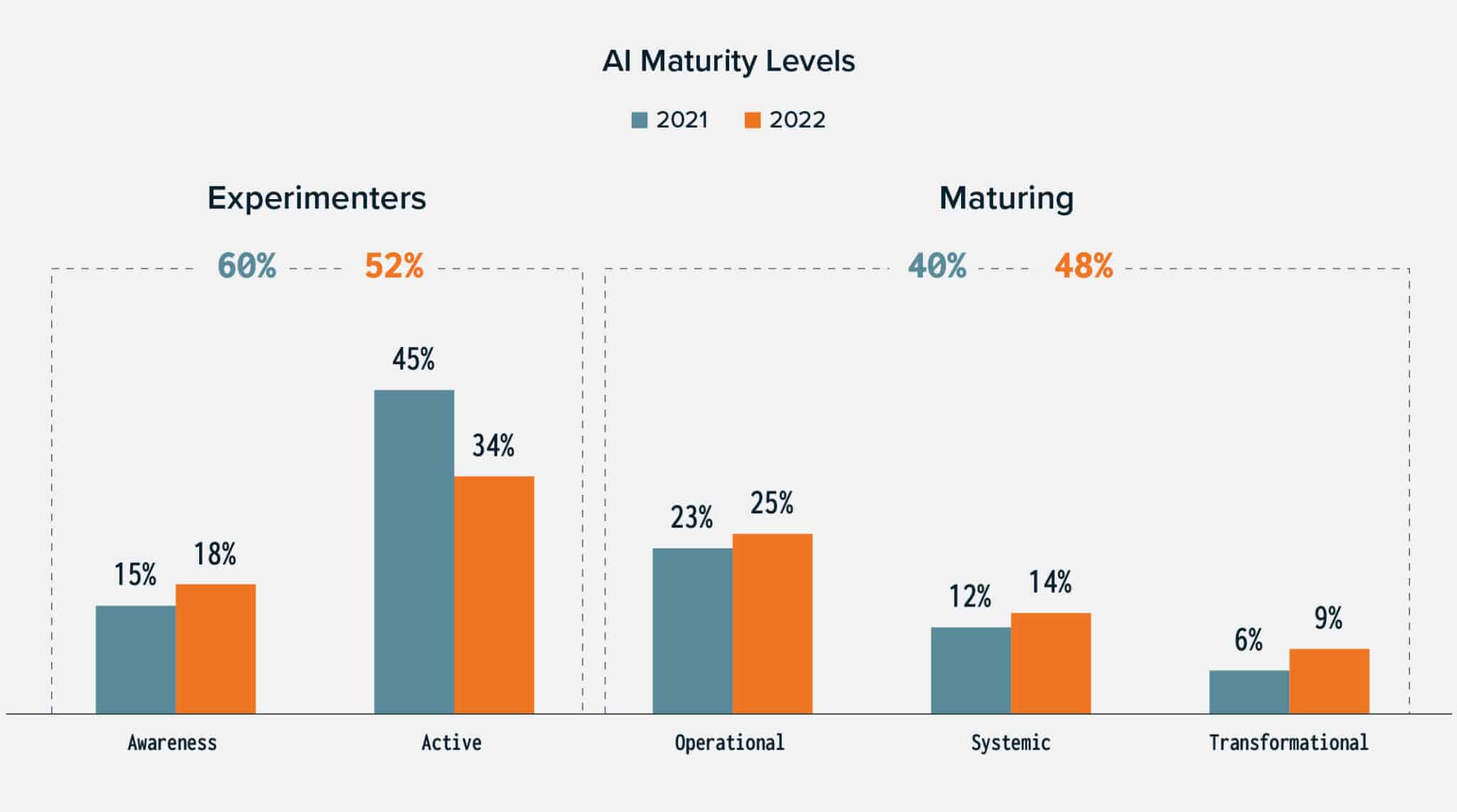

AI maturity of US organizations today

In the survey which was fielded in the fall of 2022, respondents were asked to indicate the level of AI maturity currently achieved by their organizations. The results show that 48% of US organizations consider themselves to have reached the three highest levels of AI maturity. This means that they have moved from the awareness and experimentation phases of their AI deployments to achieving demonstrable ROI from AI in production. Since last year we’ve seen an 8% increase in companies that have moved from the experimenter phase to the maturing phase, with more organizations successfully transitioning from AI experiments to AI in production.

NAICS US industry split

[2021] Q7. Looking at the Gartner AI Maturity Model diagram below, at what level of AI maturity is your organization today? n=200

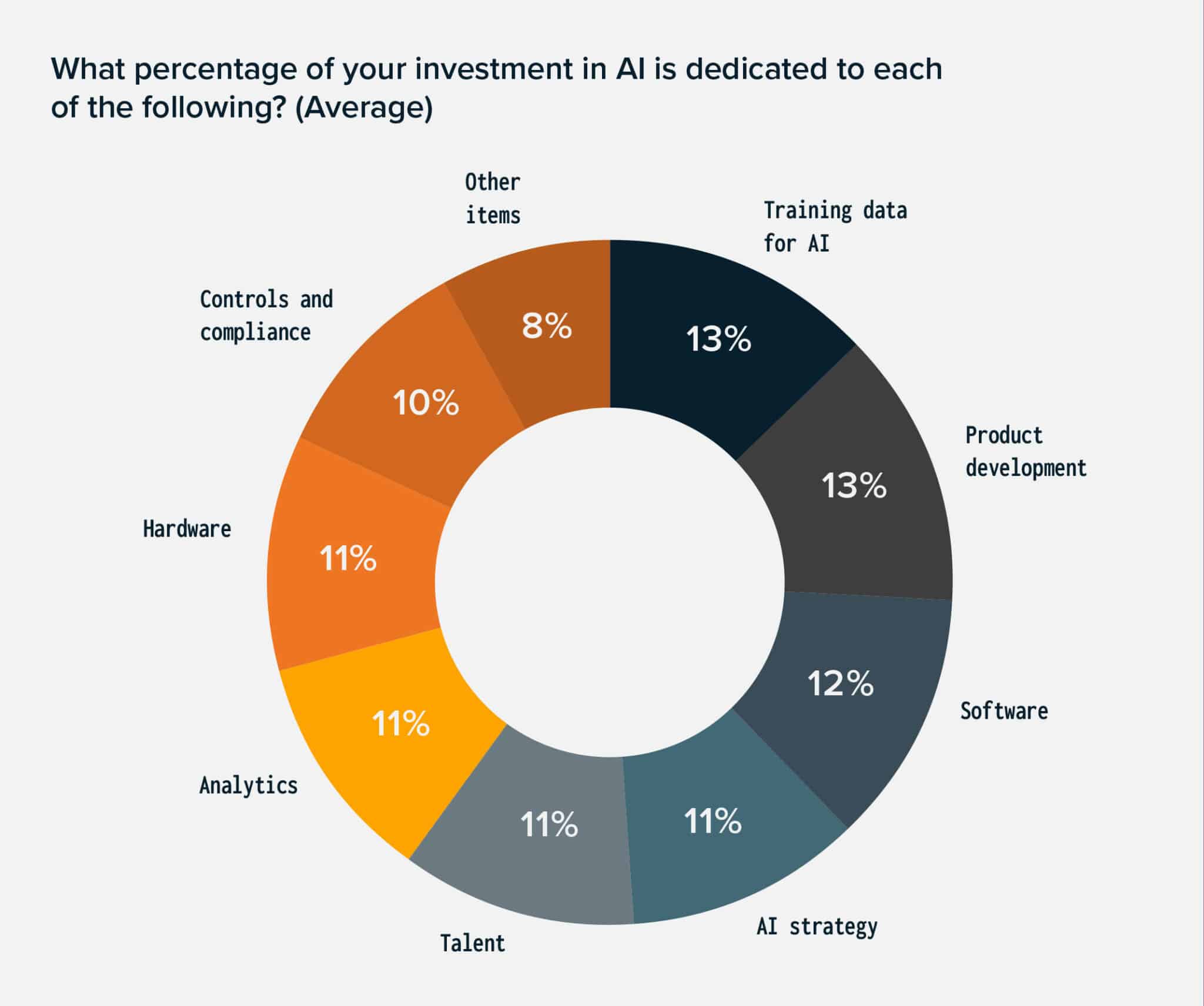

AI data investment

Want to read this report later?

AI budget distribution

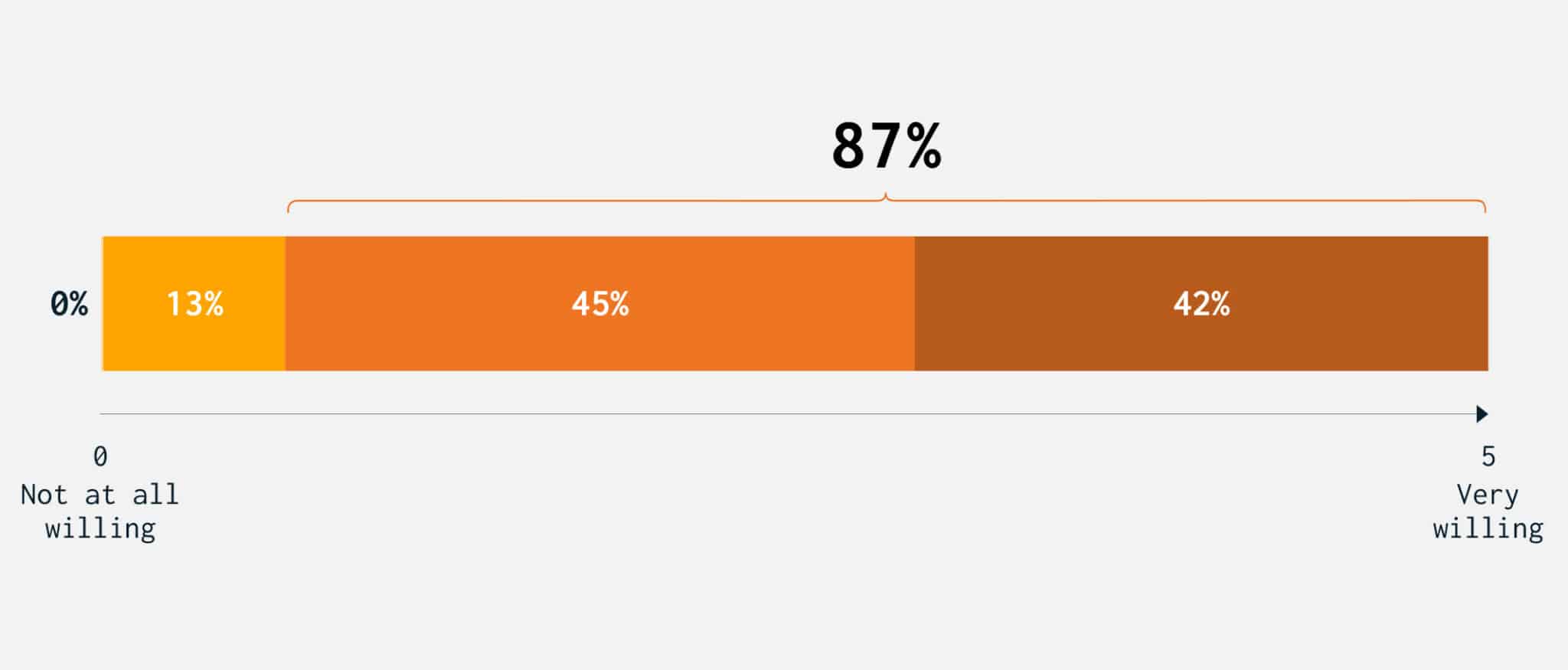

Investing in high-quality training data

How training data is sourced

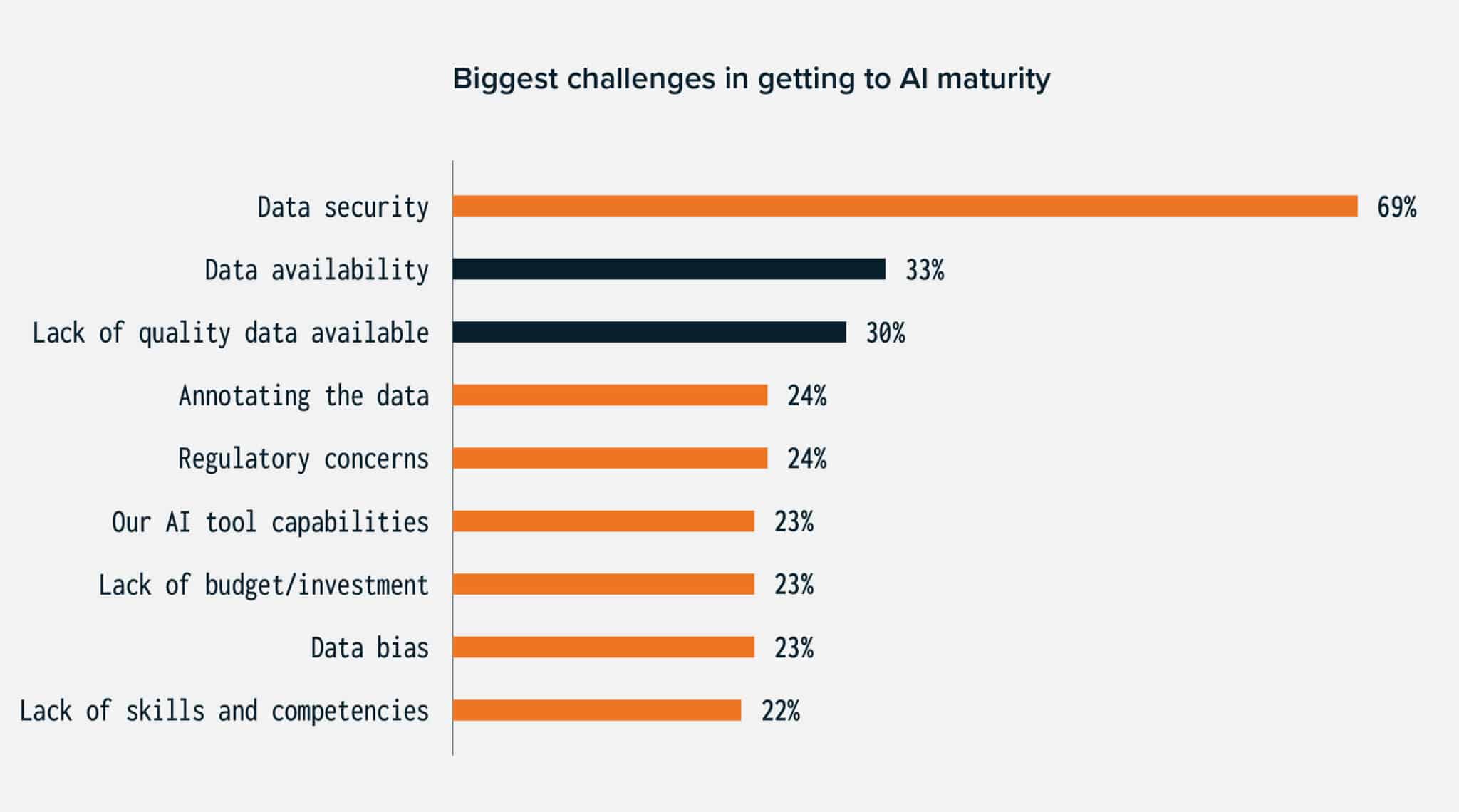

Training data challenges

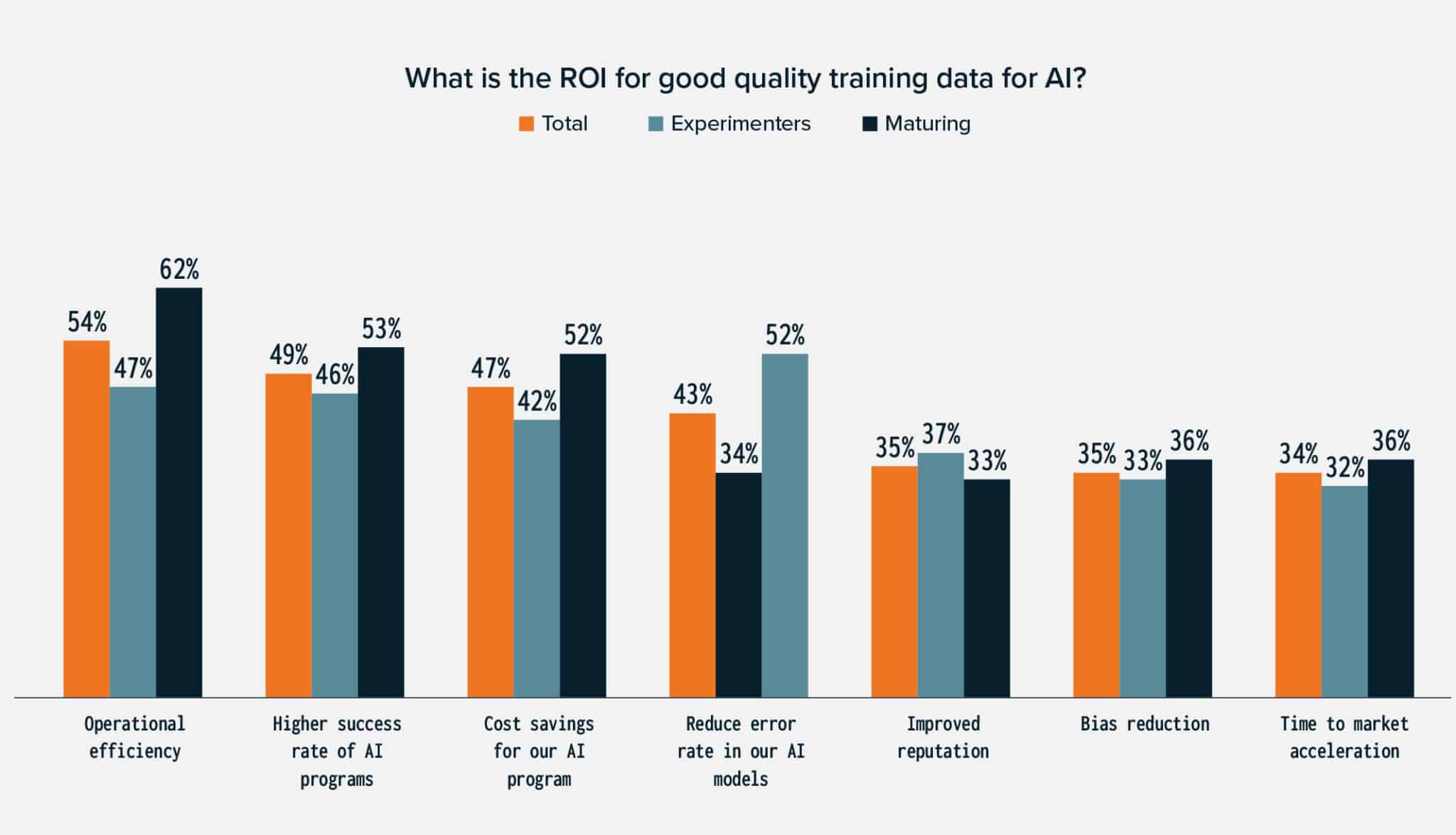

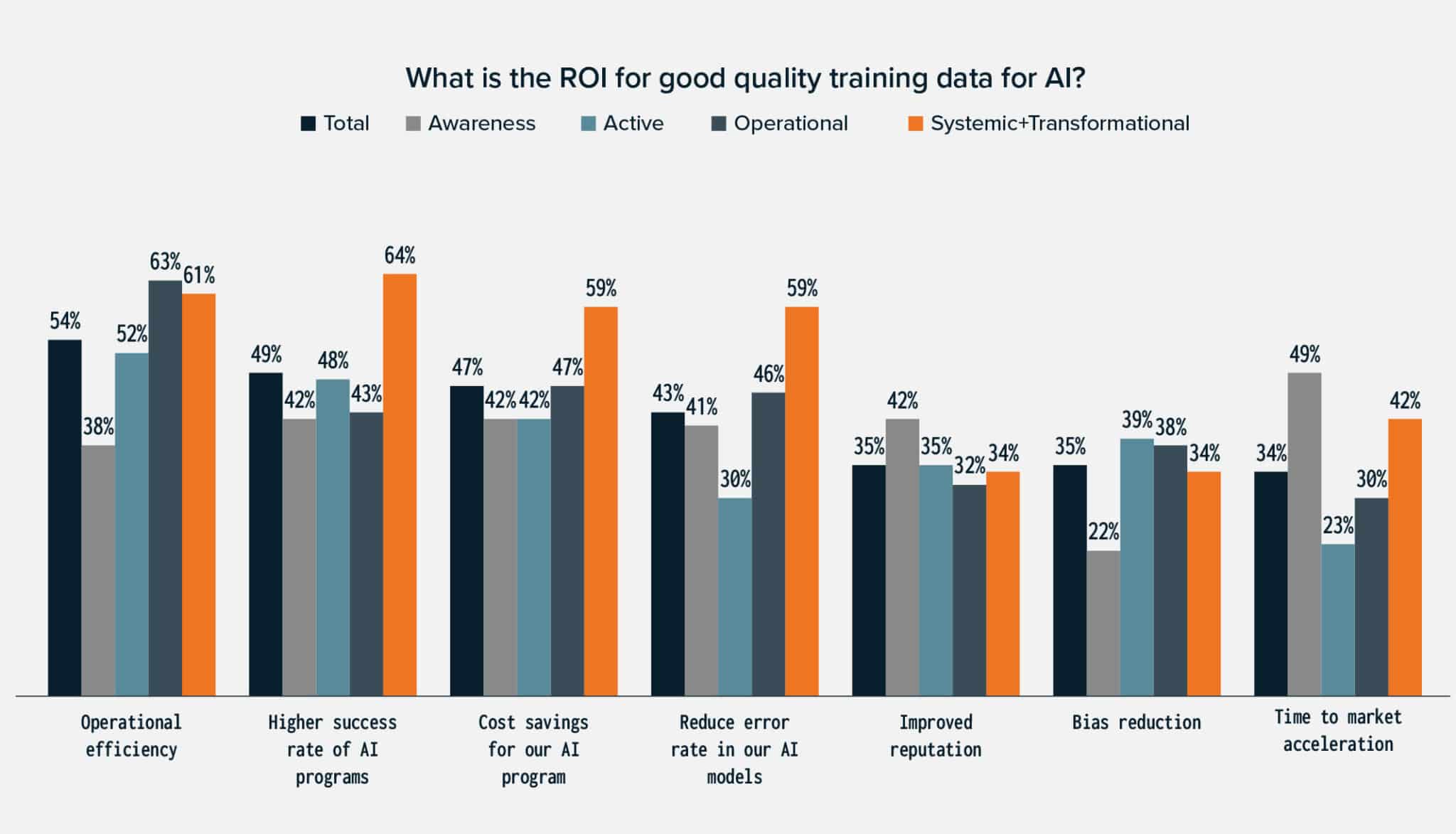

Measuring training data ROI

Enterprise training data needs

Conclusion

LXT’s research findings illustrate the important role that high-quality training data plays in an organization’s AI maturity journey. The ROI of high-quality training data is evaluated by the enterprise in multiple ways including operational efficiency, higher success rates for AI programs and cost reduction. This research study found that companies are overwhelmingly willing to pay more for their training data to ensure high-quality so they can build a strong foundation for their AI programs and set them up for success.

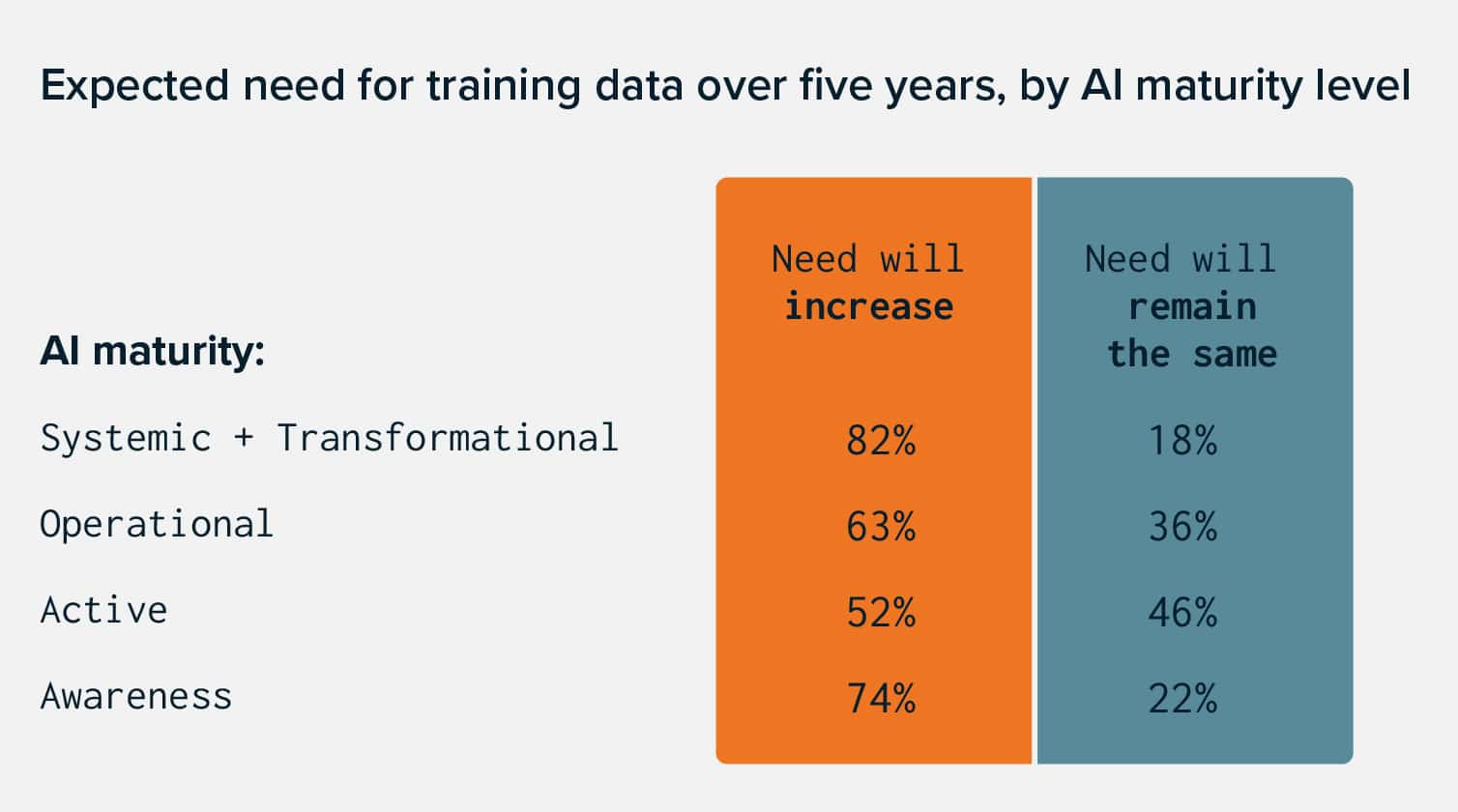

Training data is a strong need across US organizations, particularly those that have reached the highest levels of AI maturity. Companies looking to drive successful AI projects should thoroughly evaluate their training data investments to make sure they are building the data pipeline needed to ensure their projects reach their goals.

Behind the research

LXT commissioned a survey of 315 senior decision-makers working for US organizations. 46% of respondents were from the C-Suite and all those who took part had verified AI experience. Only 25% of those who applied met the criteria required for participation, which included their level of AI knowledge and experience.

Contributors were engaged using online surveys, answering on behalf of a range of business sizes, revenues and industries. Each participant represents a US organization with at least $100 million in annual revenue and over 500 employees.

The results were weighted to match the North American Industry Classification System split of companies with 500+ employees in an effort to reflect an accurate representation of the mix of US companies by industry.

The research was conducted from September 29th to October 21st, 2022, by Reputation Leaders, an independent research organization. Interviews were conducted in the US by online survey using the panel services of Borderless Access.

For questions about the research findings, please reach out to us at info@lxt ai.

About LXT

LXT is an emerging leader in AI training data to power intelligent technology for global organizations. In partnership with an international network of contributors, LXT collects and annotates data across multiple modalities with the speed, scale and agility required by the enterprise. Our global expertise spans more than 145 countries and over 1000 language locales. Founded in 2010, LXT is headquartered in Toronto, Canada with presence in Australia, Egypt, Turkey and the United States. The company serves customers in North America, Europe, Asia Pacific and the Middle East.

To learn more about LXT, visit lxt.ai.